- HOME

- Ecommerce

- Building Your Ecommerce Website

- Choosing the Best Payment Gateway for Your Ecommerce Business

Choosing the Best Payment Gateway for Your Ecommerce Business

- 12 Mins Read

- Posted on March 9, 2019

- Last Updated on October 8, 2024

- By Lauren

So you’ve decided to bring your business online? Well, first of all, congratulations. Now is certainly the time to jump on the ecommerce bandwagon; and because the realm of online retail is still fairly new, you’ll get to experience the excitement of technological advancements and new-and-improved processes in the coming years. You’ve probably begun to envision the product imagery, the design, and the messaging of your site; and you’re ready to start curating a storefront that’ll drive those conversions.

But before all that, you’ve got a few logistical details to handle on the back end—perhaps most importantly, how customers will pay you for those products you’re so thrilled to be releasing into the world. We’re starting with this element because—depending upon the payment gateway you choose—you might need to set up a merchant account, which could take up to a few weeks. So for the sake of timing, prioritize this decision. After all, no matter how good your product pages look, if you don’t have a payment gateway, no one can buy what you’re selling.

To simplify, a payment gateway is a third-party service that interfaces between the customer, your online shop, and a bank to validate the customers’ credentials and payment, authorize the transaction, and deposit the payment into your account (not to mention process returns, issue refunds, store your transaction history, and more). It takes a fairly complex series of back-end communications to make each transaction happen; on the users’ side, it’s what supports every step between the moment a visitor clicks on the “Checkout” CTA and the moment they receive the confirmation email. A strong payment gateway does all of this smoothly, quickly, and securely.

If you’ve done any research around payment gateways, you know that there are many to choose from; and the selection process might seem overwhelming. Most ecommerce platforms have integrations out-of-the-box—meaning they’ve done the work of singling out the most powerful options and narrowing down the list for you… but some of them offer so many options that the process can still feel paralyzing. At Commerce Plus, we’ve attempted to alleviate the overwhelm by integrating with only the most robust and popular payment gateways out there. For instance, if you’re using the U.S. edition, you’ll have virtually immediate access to BrainTree, Authorize.net, Stripe, 2Checkout, WorldPay, and PayPal (including Payflow Pro and Payments Pro):

If you’re elsewhere—India, for example—you’ll see a different set of payment options, including offline options like cash-on-delivery. Wherever you are, the gateways we offer are the ones you’ll see consistently on “best-of” lists. And while the reality is that there’s no “best” payment gateway, one of them will be “best” for your business.

Below, we discuss the important differences between payment gateways, as well as the factors you should consider in determining the right gateway for your operations, your customers, and your business numbers.

Modern v. Classic Payment Gateways

Let’s begin with an important distinction between “types” of payment gateway.

You’ll need a merchant account in order to accept payments online. A merchant account is not the same thing as a business bank account; the two are separate entities. For one, you can’t directly access your merchant account. Payments are deposited and temporarily held there when customers make an online payment through a gateway. The bank will then process those payments in batches—rather than one at a time—and move the funds from your merchant account to your regular bank account all at once. Typically, payments are moved from one account to the other within a few days.

The reason merchant accounts matter here is that payment gateways fall into one of two categories. “Classic” payment gateways—such as Authorize.net and WorldPay— require that you set up a dedicated merchant account. (Authorize.net provides quotes and sets you up with MerchantAccountProviders.com; both it and WorldPay will set up your merchant account for you, so you’re not necessarily left to do the work alone if you choose a classic gateway). “Modern” payment gateways—such as PayPal, Stripe, and 2Checkout—don’t require you to… because they’ve combined the merchant account and gateway into a single service. They draw the funds; they validate them; they deposit the payments directly into your account. All you’ll need is a valid business bank account to accept payments.

Because they’re an all-in-one solution, modern payment gateways are typically easier to set up—indeed, they can be set up in less than an hour—but you pay the price in higher per-transaction fees. For smaller shops, these transaction fees may not be a deal-breaker; but for shops with higher sales volumes (or shops that plan to see quick growth), these fees can add up quickly and become a financial handicap over the long-term.

While classic payment gateways can initially be more of a hassle (you have to apply for, pay for, and set up a dedicated merchant account; and you’ll need some basic technical knowledge to integrate the account via API), the per-transaction fees are lower. What’s more, you communicate directly with your bank—rather than with a middleman—about everything from declined transactions to processing errors, giving you more control in those communications. So consider how much your solution will “cost” (financially and psychologically) over the long run: A bit of hassle and a little patience with your account application early on may be worth what you save in fees—and direct access—over time.

Hosted v. Integrated Payment Gateways

But there are other ways to sort payment gateways. Whether they’re integrated into your website or hosted by a third party is another important distinction—particularly from a user experience (UX) perspective.

Hosted payment gateways redirect the customer to the payment processor’s platform to complete their payment. Gateways such as PayPal, WorldPay, and 2Checkout are hosted gateways—or at least, they offer hosted versions of their product. The primary benefit of using a hosted solution is that the gateway provider is wholly responsible for payment card industry (PCI) compliance and data security. Hosted solutions are also easy to set up insofar as they don’t require integration.

The drawback? You won’t have complete control over UX. The experience of being directed offsite can sometimes feel jarring for users, and you can run the risk of cart abandonment and lost conversions. That said, some hosted gateways allow you to customize the look and feel of the third-party platform—by adding your logo, for example, or customizing your font. When your payment pages reflect your brand’s typeface and color palette, the checkout feels more seamless from a user perspective. So if you do “go hosted,” choose a gateway that will allow you to customize as much as possible.

Pro Tip: This is one point at which demographic data will come in handy. While in some countries, hosted payment gateways aren’t trusted, in others, they’re preferred. Poll your customers or ask colleagues who run ecommerce businesses. You’ll want to know whether a hosted gateway will deter customers before you choose one.

Integrated (or non-hosted) payment gateways, on the other hand, connect to your ecommerce store via an API that the gateway provides. Examples of integrated gateways are Stripe and Authorize.net. Because payments take place directly on the retailer’s website, customers typically experience a more seamless checkout, as well as a more consistent brand experience. You’ll also have more control over important questions such as whether to offer one-page or multi-page checkout, how to style form fields, and so on.

The downsides? You might need to do some custom programming or hire a developer to get up and running; and responsibility for transaction security is in your hands. (With Commerce Plus, setting up the out-of-the-box integrated payment gateways—Authorize.net, Payments Pro, and Braintree—won’t require custom programming.) We recommend integrated gateways for bigger brands who want to offer consumers a more consistent online experience.

As we’ve mentioned, some payment gateway providers offer both hosted and integrated solutions. For example, PayPal was originally a hosted solution (it’s now called “PayPal Standard” to distinguish it from PayPal’s other offerings); but its “Payments Pro” solution can be fully integrated into your ecommerce site, allowing you to “design and host your own checkout pages for full control.”

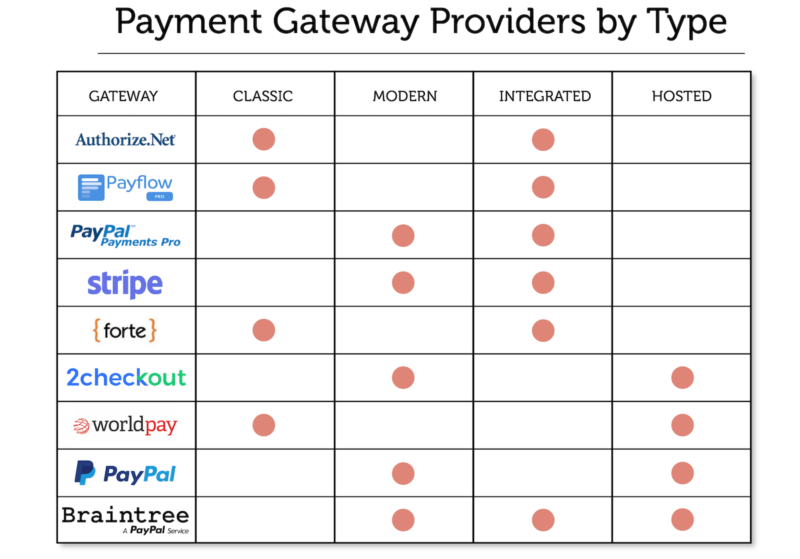

Popular Payment Gateway Providers by Type

Below is a chart that categorizes the payment gateways integrated with the U.S edition of Commerce Plus, according to type. Keep in mind that some providers do offer more than one solution in a space; but these are the categories they’re most known for:

What to Look for in a Payment Gateway Provider

By now you’ve probably got a sense of whether a modern or classic, hosted or integrated provider would be most appropriate for your business. Now you can start narrowing down your options. Keep in mind that there is no “best” payment gateway. But there is one that best meets your business’ budget, its size, its sales trends, its growth, and your customers’ expectations. Are you only selling online, or do you also have a physical store? Where in the world are your customers? If you offer an omni-channel shopping experience, what channels do you use? How many transactions do you have per month? Is your shop seasonal? These are just a few of many questions you’ll want to keep in mind as you consider the factors below:

Cost(s)

Payment gateways carry a range of costs. Are there setup or initial signup fees? Monthly usage charges? What is the per-transaction fee? (Free gateways tend to have higher per-transaction fees, while gateways with monthly fees tend to have lower per-transaction fees.) Is the transaction fee fixed or variable? Does the gateway charge different rates to process different types of cards or transactions—online versus in-store, for example? Is there a separate gateway fee for each transaction? What about early termination or cancellation fees? Monthly minimum fees? Statement fees? Customer service or support fees? Are there fees to process refunds? Does the processor keep the fees on return transactions? Ask every question you can. Of course, how (or whether) each of these fees will ultimately affect you will have everything to do with your business: revenue consistency, transaction frequency, frequency of returns, and so on. This part will take some math; but it’ll be well worth it.

You can find the pricing plans for Authorize.net, Stripe, Worldpay, 2Checkout, BrainTree, PayPal, Payflow Pro, and Payments Pro at these respective links. Most of these pricing pages contain FAQs about additional fees; but contact the gateways you’re interested in with any lingering questions you might have.

Security

Consumers’ concerns about the safety of their data is one of the biggest drivers of cart abandonment, so trust is a crucial consideration. (Of course, every payment gateway that’s integrated with Commerce Plus is Level 1 PCI DSS compliant. That acronym stands for “Payment Card Industry Data Security Standard”; Level 1 is the most rigorous certification level available in the payments industry.) You can read more about each gateway’s security features at Authorize.net, Stripe, Worldpay, 2Checkout, BrainTree, and PayPal. If you’re considering other gateways, Level 1 PCI DSS compliance is the first thing to look for. But you should also ask about SSL certificates, CVV2 verification, fraud detection, and encryption standards. As we mentioned, choosing a hosted solution means handing over the responsibility for security; but even if you go this route, you’ll want to choose a trustworthy solution.

Cards and currencies accepted

Not all payment gateways will accept all credit cards. Some will accept various forms of payment, well beyond credit cards: Visa Checkout, Apple Pay, Google Wallet, cryptocurrencies such as Bitcoin, and so on. And while the majority of your customers will probably check out using a debit or credit card (at least in 2019), payment trends are changing. According to WorldPay’s 2018 Global Payments Report, by 2022, credit cards will make up only 17% of ecommerce payments, while eWallets will make up 47%. Consider this alongside the fact that 24% of shoppers say they’ve abandoned a shopping cart because their preferred method of payment wasn’t available. In other words, depending on the demographic you serve, you’ll want to choose a gateway that accepts those alternative payment methods. You don’t want a cart abandonment issue that stems from a shortage of options. Your gateway should offer what consumers are asking for.

Demographics will help you determine which countries and currencies you’ll need your gateway to support. (Whether you plan on only shipping nationally or are willing to ship internationally, we have a list of the countries our integrated payment gateways support here.) Obviously, your payment gateway needs to support the country you’re doing business in; but it also needs to support your target locations—all the countries you’re willing to accept payments from and ship to. We highly recommend a gateway that can take international payments. Does it provide Dynamic Currency Conversion (DCC), allowing site visitors to choose their preferred currency at payment? Don’t limit your business’s ability to expand internationally because of your payment gateway choice.

Recurring payments

If your business will be offering subscriptions (whether weekly, monthly, or annually), payment plans, or consumer financing, you’ll want the option of setting up an automatic billing cycle. Does the payment gateway offer recurring billing as a feature? Will it allow changes to payment due dates and amounts due, or do you have to cancel and restart the subscription in order to do this? Don’t make your customers manually renew their subscriptions with you every month… we guarantee that many of them won’t. (You can find the details for recurring billing for Authorize.net, Stripe, Worldpay, 2Checkout, BrainTree, PayPal, Payflow Pro, and Payments Pro at these respective links.)

User experience

We’ve already discussed the difference—from a user perspective—between staying on-site and getting joltingly redirected to a new site for payment processing. But “user experience” encompasses much more than this. How quick is the checkout process—including during peak seasons and other high-traffic periods? How many steps must the customer take to get from the shopping cart to the confirmation screen? Can you remove superfluous form fields to reduce friction? Are visitors forced to register for an account to complete checkout, or can they check out as guests? If a transaction is declined, can the gateway provide the customer with the reason for the decline? Is it as easy to check out on a mobile device as it is on a desktop?

Getting a demo from the payment gateway is often the best way to answer these questions, while putting yourself in your prospective customers’ shoes and learning the interface. You shouldn’t have difficulty asking for a demo from a gateway provider; some—like PayPal—offer demos directly on their websites. Ultimately, you want a simple, intuitive, seamless, and hassle-free experience. Note that this may mean not choosing the least expensive solution… but it’ll be well worth it, because customers who have pleasant user experiences are all the more likely to reward you with their loyalty.

Limits

By “limits,” we mean two things: 1) Does the gateway limit how much you can process? (These are called “credit card processing limits” or “monthly volume limits.”) If you plan on growing quickly, or a busy season is imminent, the last thing you’ll want is to turn down orders. 2) If you terminate your relationship with the gateway, do you maintain ownership of your customers’ data, or do you cease to have access to it? As you can imagine, this is a crucial thing to know up-front.

Support

Finally, there’s the question of assistance. Some payment gateways don’t provide customer support; some provide 24-hour support with exceptionally rapid response times; some provide live technical support but only within standard working hours; and so on. And of course, some of them charge additional fees for that support! Undoubtedly you’ll want support of some kind when it comes to technical issues, disputed transactions, or filed complaints. The size of your business, the frequency of your sales, and any number of other factors will determine how “on-call” you need support to be. Be sure to ask about the medium through which they offer support (email, phone, etc.), whether it’s live or automated, and what their average response and resolution times are. The quality of support you get, after all, will directly impact your business.

You can find the details for support services for Authorize.net, Stripe, Worldpay, 2Checkout, BrainTree, PayPal, and Payflow Pro on their respective websites. Click around to get a sense of how comprehensive their support offerings are… and of course, you can return to the pricing pages we linked to above to see how support factors into the pricing for each.

The Point is to Begin

We’re nearly certain that one of the payment gateways above will suit your needs; but if not, you can find lists of payment gateways with the touch of a few keys through Google. Our advice, however, is not to get so caught up in comparing that you delay getting your business up and running.

There’s no way around choosing a gateway. So do a bit of research, choose what feels right, and run with it. For the most part, switching gateways is an easy operation, so you can always make a transition in the future. If you’re a smaller or new business, you probably don’t have all the time (or money) in the world to put into a complex gateway. So don’t! PayPal, for instance, is a powerful—and popular—option for new-or-small businesses because it’s modern and hosted: You won’t have to worry about setting up a merchant account or site integration with APIs. Don’t think too far into the future; make the choice that fits your business now. You can always scale up when the time is right.

Now that you know how you’ll accept payments, there’s another back-end question to answer: How to know what to charge your customers for shipping. In the next section, we’ll walk you through the answer to that question.