- HOME

- HR insights

- Form 941: Understanding its basics

Form 941: Understanding its basics

- Last Updated : June 10, 2024

- 590 Views

- 5 Min Read

If you have employees, it's essential that you ensure compliance with labor laws by filing the necessary paperwork. One of the most important compliance documents any US-based business is Form 941. If you're new to filing Form 941 or looking to get more detailed information about it, check out our breakdown below.

What is Form 941?

Form 941 is a US tax form that employers must file quarterly to report that they've accurately withheld income tax, Social Security tax, and Medicare tax from their employees' paychecks. This form is also required to report Social Security and Medicare taxes paid directly by the organization.

What is the purpose of filing Form 941?

As per federal law, if you pay employees on a regular basis, you're required to withhold a certain amount from their wages for income tax, Social Security tax, and Medicare tax and remit that amount to the IRS. The purpose of form 941 is to ensure that employers are adhering to federal tax laws; the IRS compares and matches the amounts reported on the form with the amount of taxes that the employer has deposited throughout the quarter.

What information is required to file Form 941?

To file Form 941, you will need:

An employer identification number (EIN), which is an unique ID that is assigned by the IRS to identify each US-based employer.

Complete data of each employee for the quarter, including their name, social security number, salary paid, and total taxes withheld from their cost to the company (income tax, Social Security tax, and Medicare tax).

Evidence for the tax deposited during the deposit schedule provided by the IRS, including deposit receipts or electronic confirmation numbers.

Information of the person authorized to sign and submit the form 941 on behalf of your business

An online signature PIN, which is a unique, self-selected PIN used for electronically signing and submitting tax returns; if this PIN is not available, you will need Form 8453-EMP, which is a declaration form used to authorize the electronic submission of employment tax returns.

What are the additional requirements to file Form 941?

Form 941 Schedule B is a tax form used by semi-weekly schedule depositors to report the taxes they owe to the IRS for a quarter. This applies if your reported employment taxes in the lookback period exceed $50,000, or if your tax liability is $100,000 or more on any given day during the current or prior tax year. Even if you're not normally a semi-weekly depositor, you need to file Schedule B if your accumulated tax liability reaches $100,000 or more on any day.

When is the deadline to file Form 941?

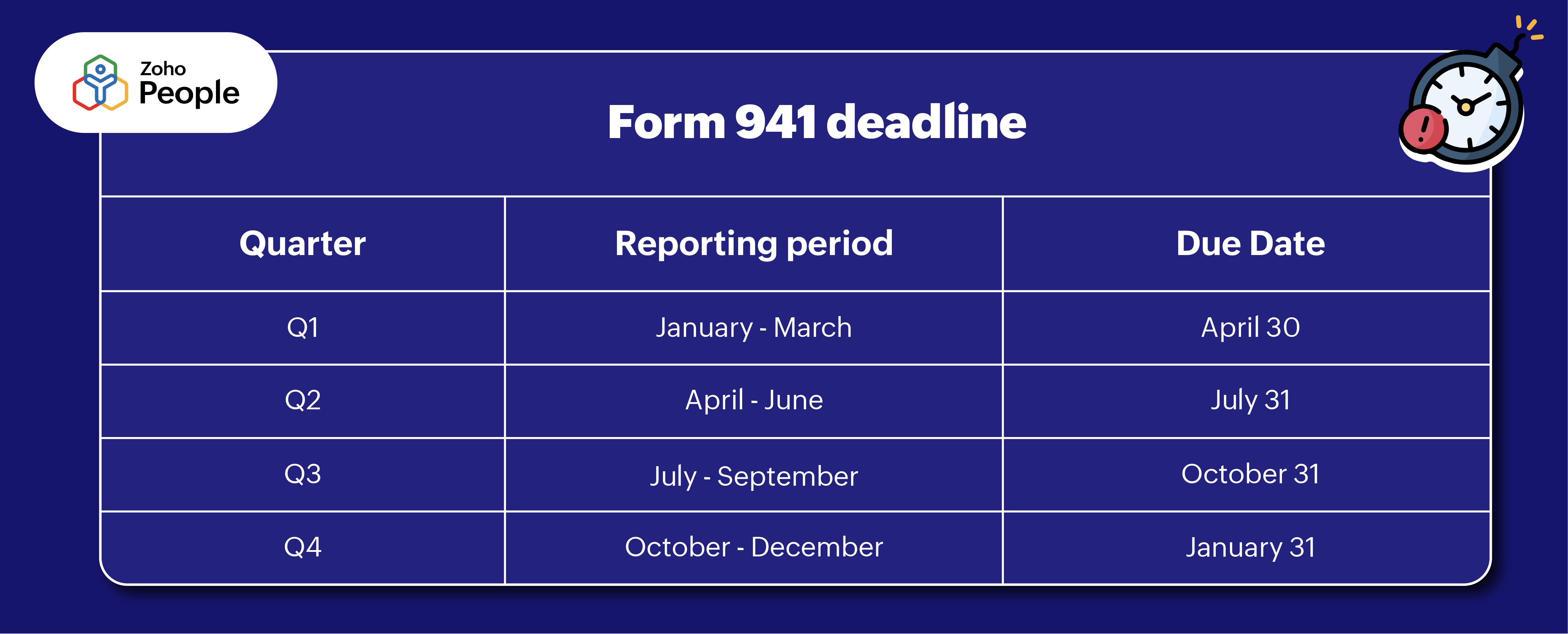

Employers are required to file Form 941 every quarter. The deadline usually falls on the last day of the month that follows the completed quarter.

First quarter (January, February, and March): April 30

Second quarter (April, May, and June): July 31

Third quarter (July, August, and September): October 31

Fourth quarter (October, November, and December): January 31

If the deadline falls on a weekend or a holiday, employers should file on the next business day.

What is the penalty for failing to file Form 941?

Organizations that do not file Form 941 or fail to submit their taxes on time face significant penalties. Typically, these penalties are calculated based on the amount of outstanding taxes that the organization owes to the IRS.

1. Initial penalty

A penalty of 5% of the tax amount due is initially imposed.

2. Penalty for continued failure

If the organization continues to fail to file Form 941, an additional 5% penalty can accrue each month for up to five months.

3. Interest on continued failure

If Form 941 is not filed even after the five-month period, an interest amount will be levied on the total accumulated penalty amount.

4. Late payment penalty

If the organization fails to pay the taxes owed to the IRS despite filing Form 941 on time, an additional penalty is levied by the IRS for late payment. The late payment penalty ranges from 2% to 15%.

What are the different methods to file Form 941?

There are two main methods for filing Form 941:

E-filing: Most organizations prefer to electronically file their Form 941, since it's an accurate and quick method. Most of the time, organizations receive acknowledgement for filing Form 941 within 24 hours. You can file the form through the IRS authorized e-filing service providers. All you have to do is fill out the form, make the payment if required, make sure the given details are correct, e-sign the form, and transmit it electronically to the IRS.

Paper-based filing: If you opt for paper-based filing, all you have to do is download Form 941 from the IRS website, fill it out completely, and mail it to the IRS department. If you need to make a payment, you should include a payment voucher along with the form. The address to which you mail the form is based on whether you mail it with or without payment, as well as the location your organization operates from. Find out your exact mailing address.

Please note that if you have ten or more forms to file, you need to do it electronically.

What are the other 94x forms?

Here's a quick rundown of other 94x forms that you should know about:

Name of the form | What is it? |

Form 941 Schedule R | Section 3504 agents and certified professional employer organizations (CPEOs) file Form 941 Schedule R to allocate the wages reported on Form 941 to each of their clients. |

Form 941 PR | Employers based out of Puerto Rico file Form 941 PR to report the income, Social Security, and Medicare taxes that they've withheld from their employees. |

Form 941 SS | Employers with workers based out of American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands file Form 941 PR to report the income, Social Security, and Medicare taxes that they've withheld. |

Form 940 | Form 940 is used to report annual Federal Unemployment Tax Act (FUTA) tax. It applies to employers who paid $1,500 or more in wages to any part-time or full-time employees, as well as employers who had one or more W-2 employees (full-time or part-time) for at least 20 weeks in the previous tax year. |

Form 940 Schedule R | Section 3504 agents of home care service recipients and CPEOs file Form 940 Schedule R to allocate the wages reported on Form 940 to each of their clients. |

Form 940 PR | Form 940 is used to report annual Federal Unemployment Tax Act (FUTA) tax by employers based out of Puerto Rico. |

Form 940 Amendment | Form 940 Amendment is used to correct any errors in Form 940. |

Form 943 | This applies to employers who paid wages to farm workers if the wages were subject to federal income tax withholding or Social Security and Medicare taxes. |

Form 944 | Filed once a year, form 944 is applicable to small businesses whose annual tax liability is $1,000 or less. |

Form 945 | Form 945 is filed to report income taxes withheld from non-payroll payments. |

Form 941-X | Form 941-X is used to correct any errors in Form 941.

|

Form 941-X(PR) | Form 941-X(PR) is filed by employers based out of Puerto Rico to make changes to the errors made in Form 941. |

Wrapping up

Filing form 941 every quarter helps you maintain compliance with federal tax obligations and ensures you avoid unwanted penalties from the IRS. We hope this blog post gave you a clear idea about the different aspects of form 941!

Tarika

TarikaContent Specialist at Zoho People