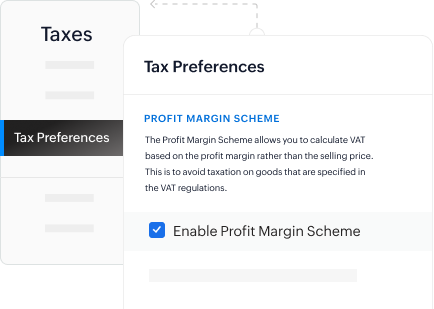

Simplify VAT with Profit Margin Scheme in Zoho Books

The Profit Margin Scheme (PMS) lets businesses calculate VAT on the profit margin (selling price minus purchase price) instead of the full sales value, avoiding double taxation. It’s especially useful for second-hand goods, antiques, and collectibles.

How Zoho Books supports the Profit Margin Scheme?

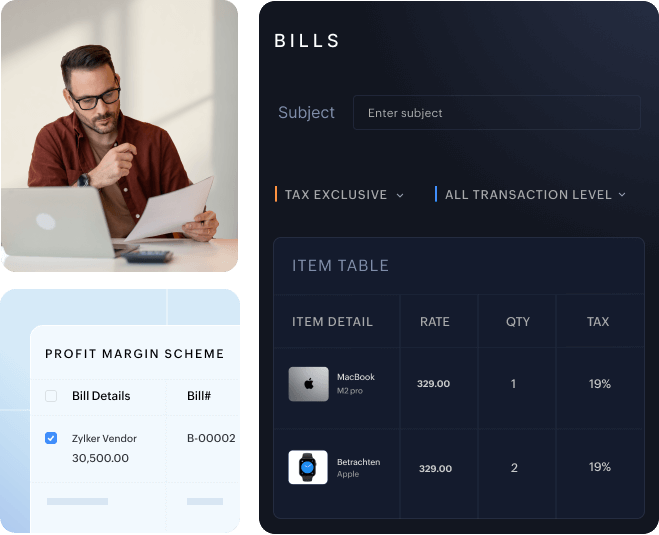

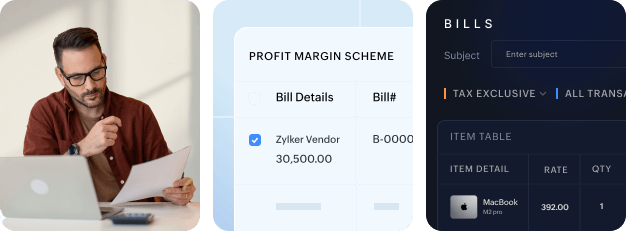

Automated VAT calculations

Zoho Books automatically calculates VAT on profit margins, saving your time on manual entries.

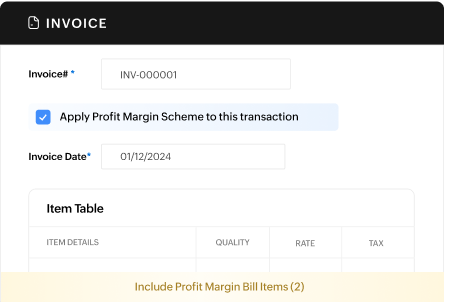

Quick transaction recording

Easily record sales and purchase transactions under the scheme in just a few clicks.

Understanding Profit Margin Scheme: Goods, Conditions, Records

Eligible Goods under PMS

VAT can be calculated based on the profit margin for specific goods, including second-hand items, antiques that are over 50 years old, and collector’s items such as coins and stamps.

Conditions for eligibility

A taxable person can apply the Profit Margin Scheme to eligible goods purchased from an unregistered person or a taxable person who previously applied the scheme on the same goods. Input tax must not have been recovered as per Article 53 of the VAT Executive Regulations.

Required records for compliance

Maintain records for goods bought under the scheme, including purchase invoices with the seller’s details, purchase date, goods description, total amount payable, and the seller's or signatory's signature.