Zoho Payroll is everything you need to administer payroll for your organization. You can grant user roles and permissions, delegate responsibilities, oversee approvals, and build your organization your way.

Zoho Payroll is everything you need to administer payroll for your organization. You can grant user roles and permissions, delegate responsibilities, oversee approvals, and build your organization your way.

Enter your organization details, tax information, employee details, salary components, and pay schedule to get your payroll up and running right away.

While you continue expand your business, we help you distribute the same perfect payslips across all your branches in different states.

Choose different allowances, earnings, reimbursements, and prerequisite for different employees. Easily enable or disable individual components, and Zoho Payroll will adjust to your settings and calculate the right pay.

Choose from the list of preset allowances or tailor allowance categories to support your employees while they support your business.

Define your organization's FBP, reimbursement claims, and submission rules for IT declarations and investment proofs. You can collect POIs in multiple phases and set the dates when the resulting tax adjustments will be reflected in your employees' pay.

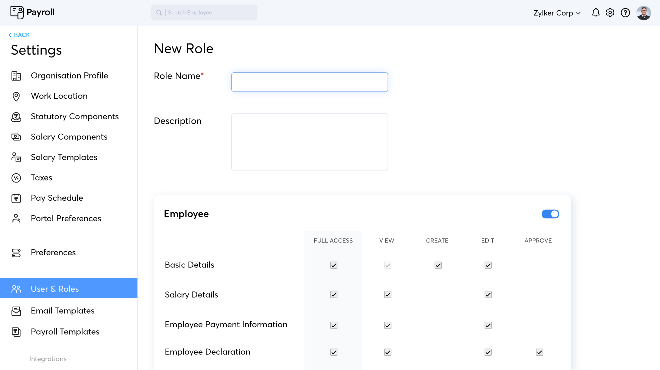

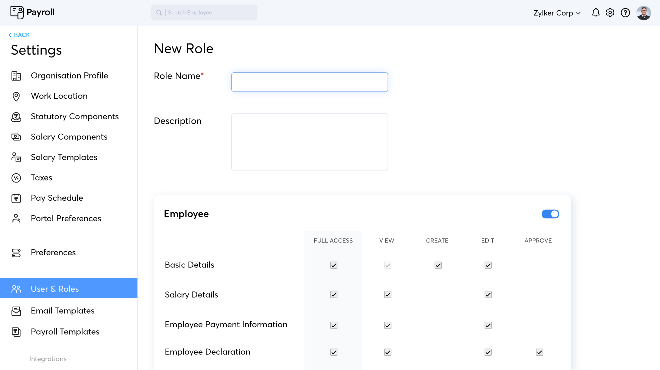

Create multiple user roles to help your finance, admin, and auditing teams collaborate effortlessly. Ensure data integrity by granting users role-based access to the specific modules they need.

Share your workload and get work done faster. Use controlled access to invite your qualified staff to administer payroll.

Create payroll approval workflows and ensure pay runs get processed only after they get the go-ahead from you or your payroll administrator.

Send broadcast reminders with the due dates to submit investment proofs, income tax, or flexible benefit plan declarations.

Receive personalized notifications and stay on top of everything that happens within your organization, from adding new employees to your payroll system to setting up their bank information and transferring salaries.

Get a holistic summary of your entire payroll operation. Check for pending pay runs, outstanding taxes and forms, employees under your payroll, and payroll expenses incurred, all from your dashboard.

Support your organization's salary structure with personalized salary templates for various job roles. Associate a template with each employee and see their salary details get populated automatically.

Choose from our collection of templates to build payslips with a clear breakdown of salary components, allowances, taxes withheld, and deductions. .

Invite employees with a personalized message to get their work done, while you get your work done.