What if I need to schedule earnings that are not part of an employee’s CTC?

Note: This feature is only available in early access. Contact support@zohopayroll.com to get access for your organisation.

Here’s how you can schedule earning that are not a part of CTC or salary structure of an employee. Here’s how:

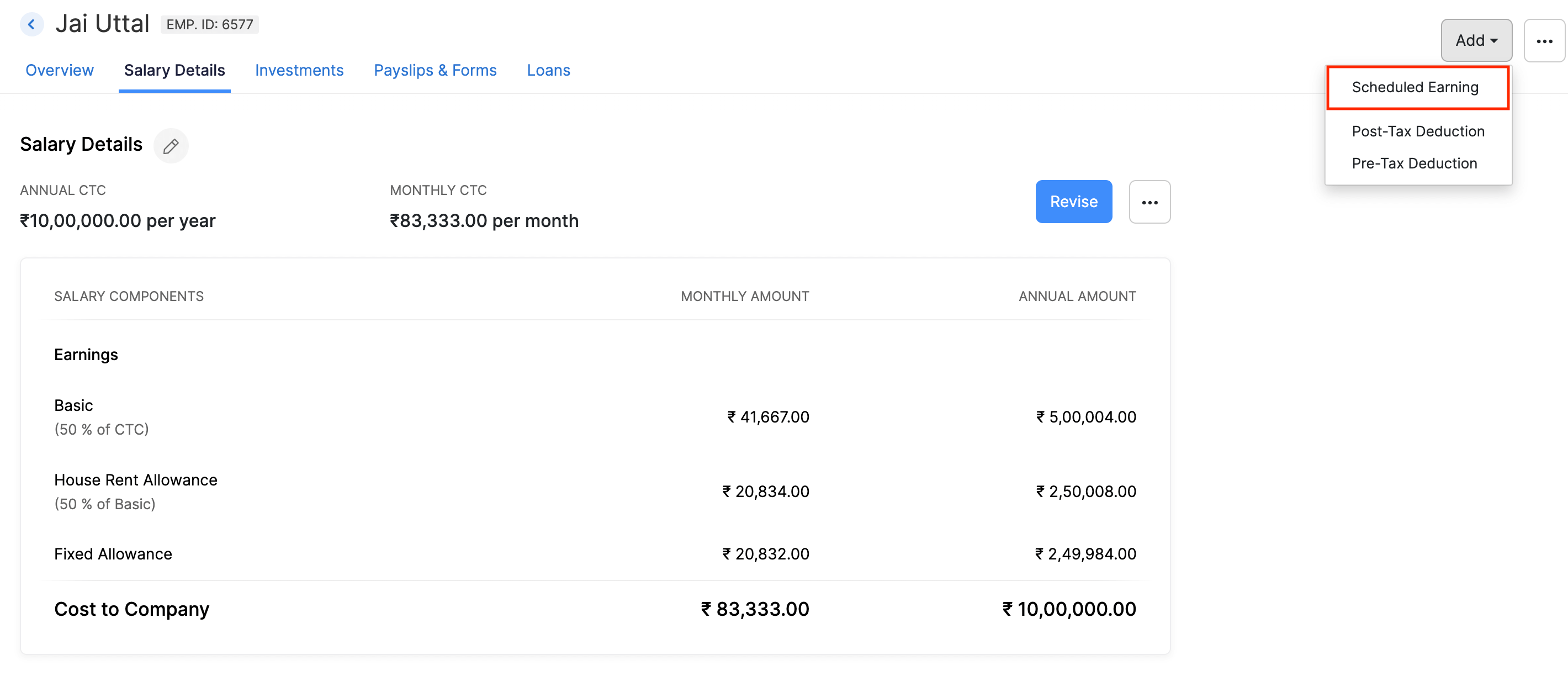

- Click Employees on the left sidebar and select an employee.

- Switch to the salary details tab.

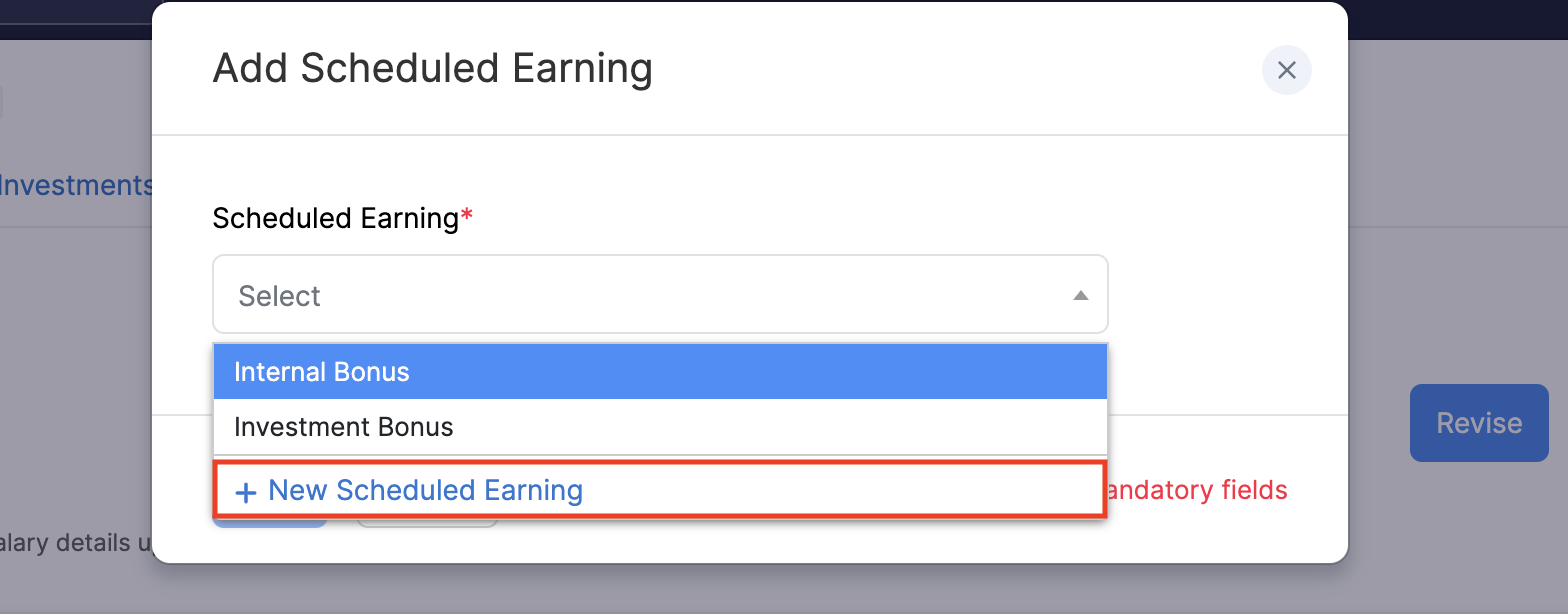

- Click + Add in the top right corner and Scheduled Earning.

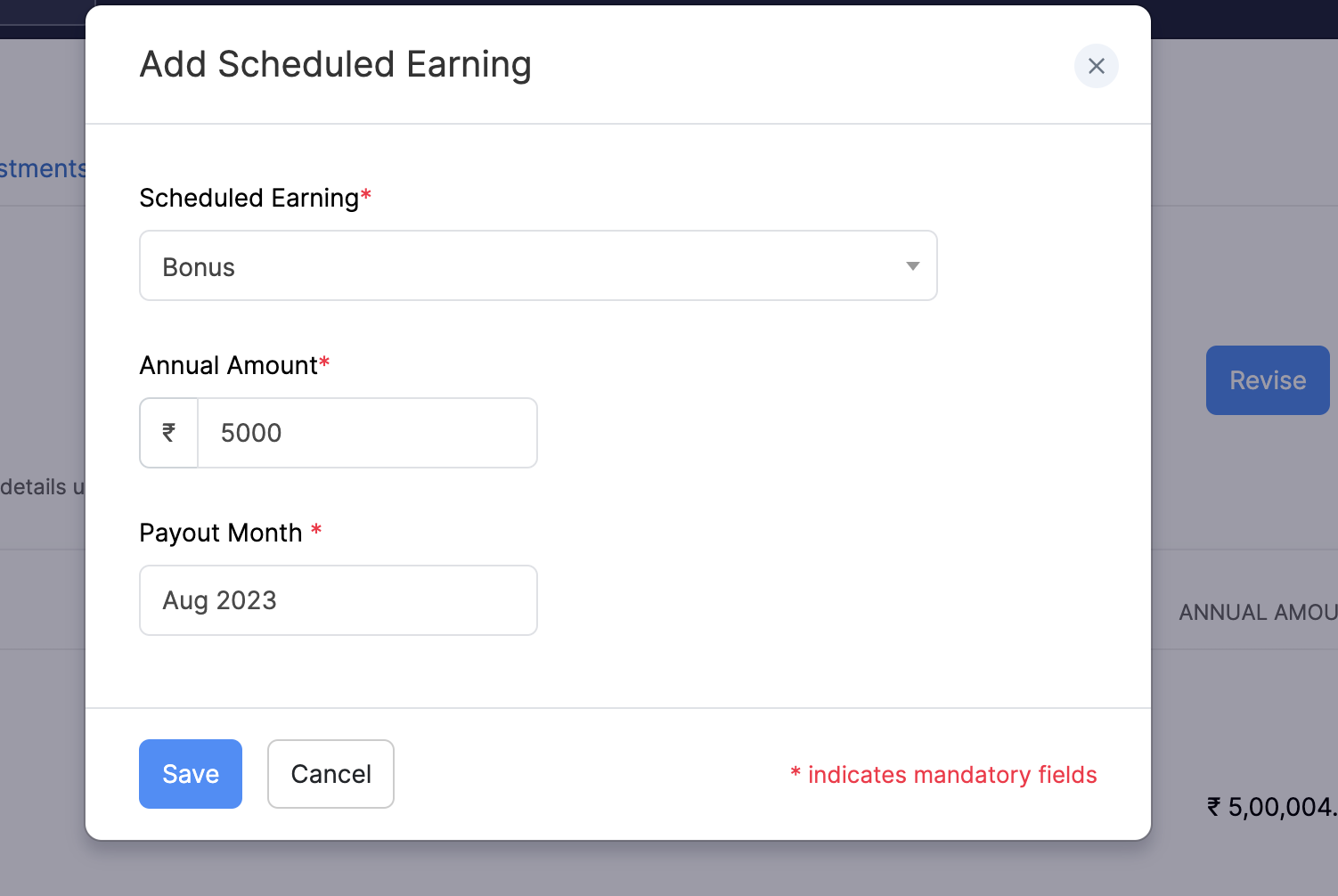

- Select an earning.

Note: You can only select earnings that are not part of employees’ CTC or salary structure.

- Enter the annual amount and payout month.

- Click Save.

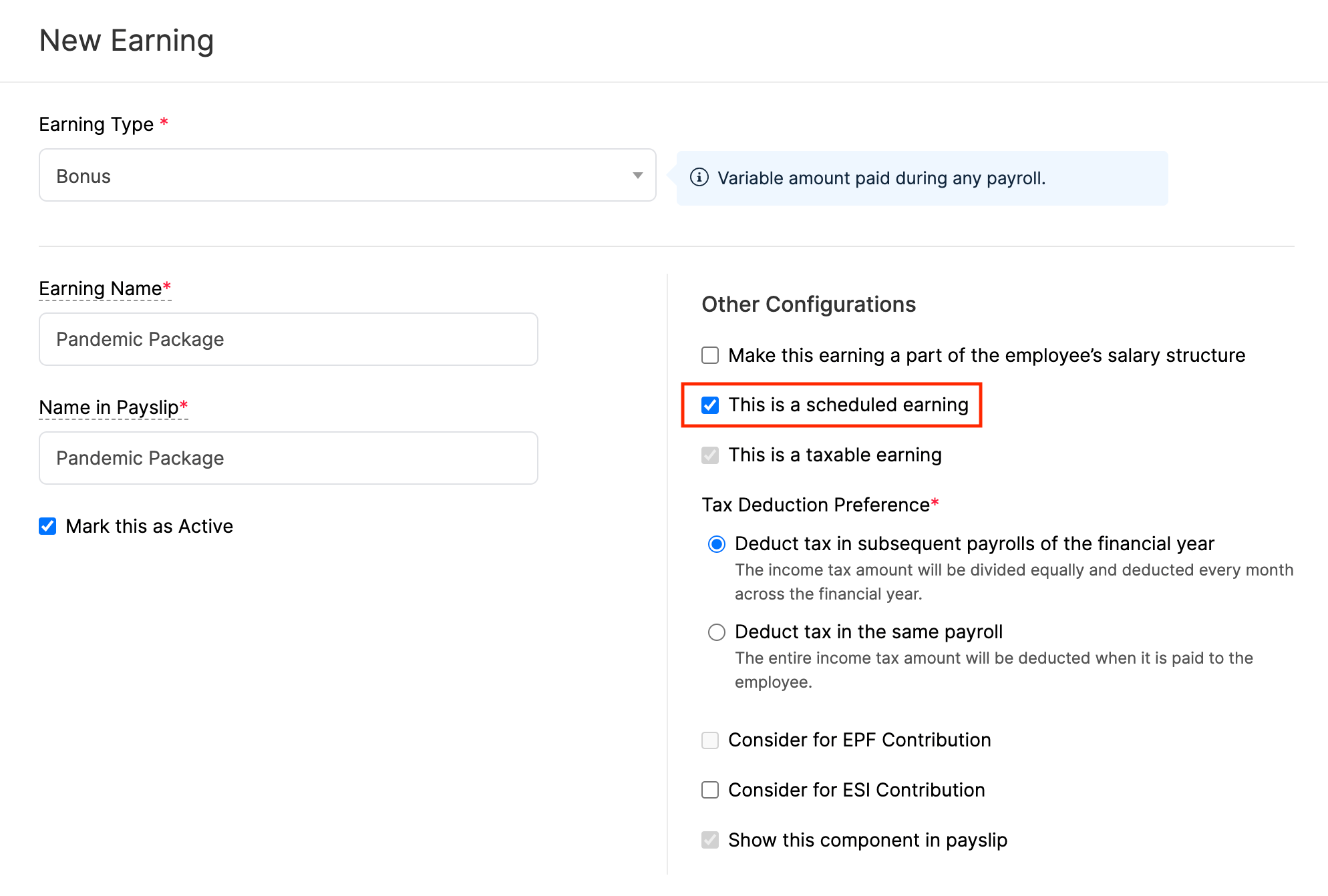

Pro-tip: You can select + New Scheduled Earning if you do not find the earning you’re looking for.

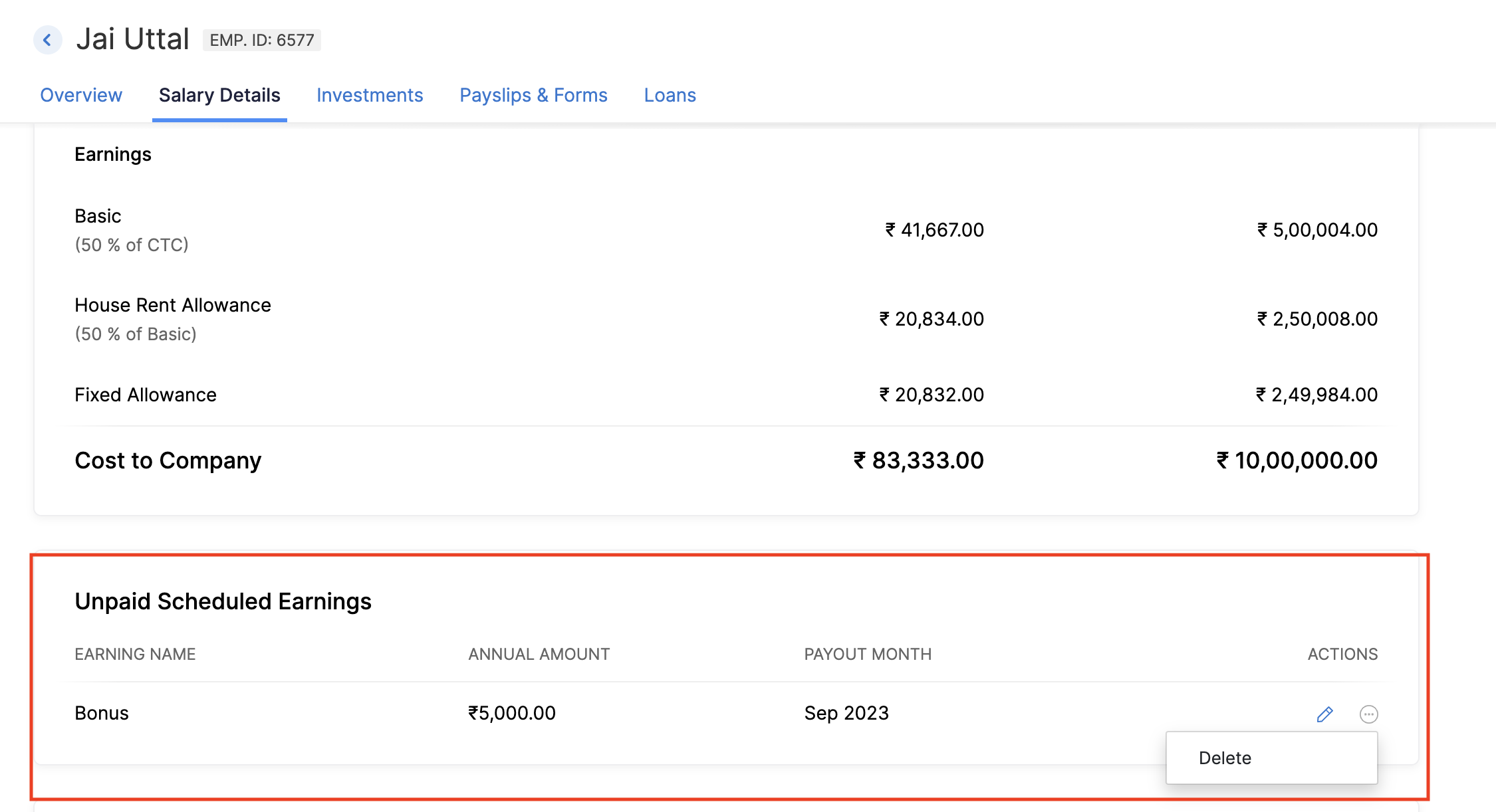

Once you’ve added the earning to the employee’s salary details, you will be able to edit or delete it.

Importing scheduled earnings that are not part of CTC

When dealing with multiple scheduled earnings that are not part of CTC, you can efficiently import them into Zoho Payroll. Here’s how:

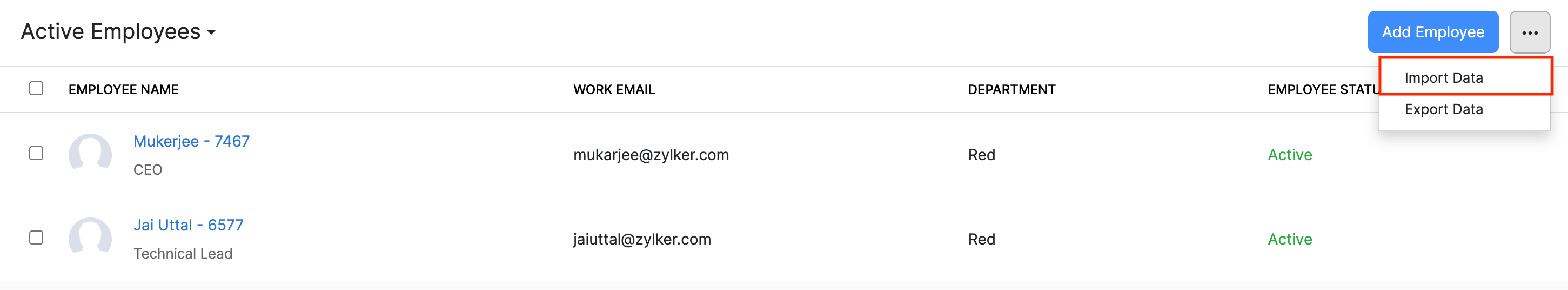

- Click Employees on the left sidebar.

- Click the More icon in the top right corner and click Import Data.

- Select Employee Scheduled Earnings as the import type.

- Click Proceed.

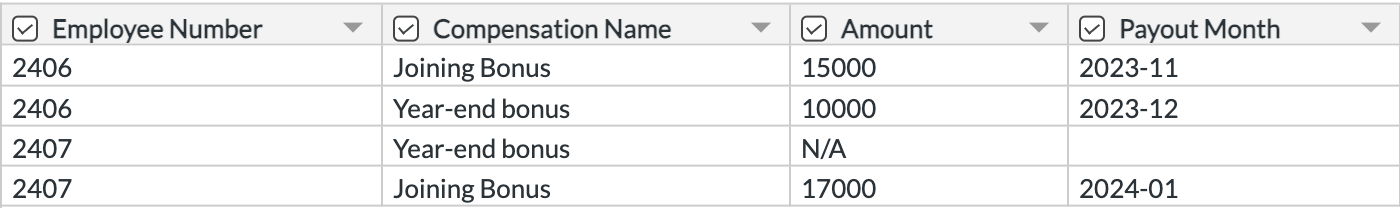

Upload the file containing the list of scheduled earnings that are not part of CTC. If you are unsure of the format, refer the image below.

- Select how you want to handle duplicate entries.

- Map the import file fields with the fields in Zoho Payroll and click Import.

The file will be imported and the scheduled earning details will be mapped against each employee.