Can I override income tax for all employees at one go?

Yes, you can import the income tax amount for all employees while processing the pay run. To do this:

- Go to the Pay Runs module.

- Click Create Pay Run or View Details if you already have a draft pay run.

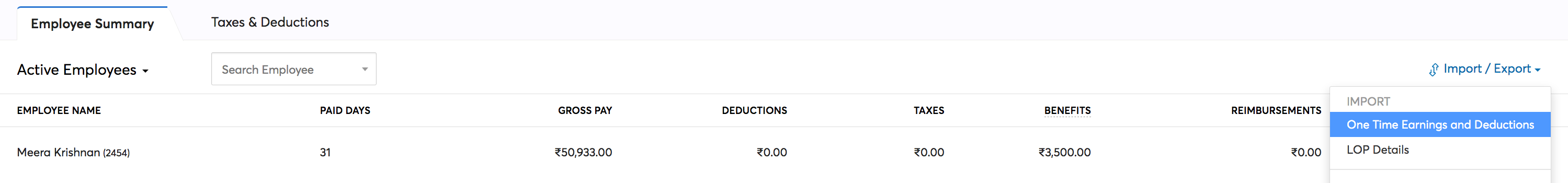

- Click Import/Export > One-time Earnings and Deductions.

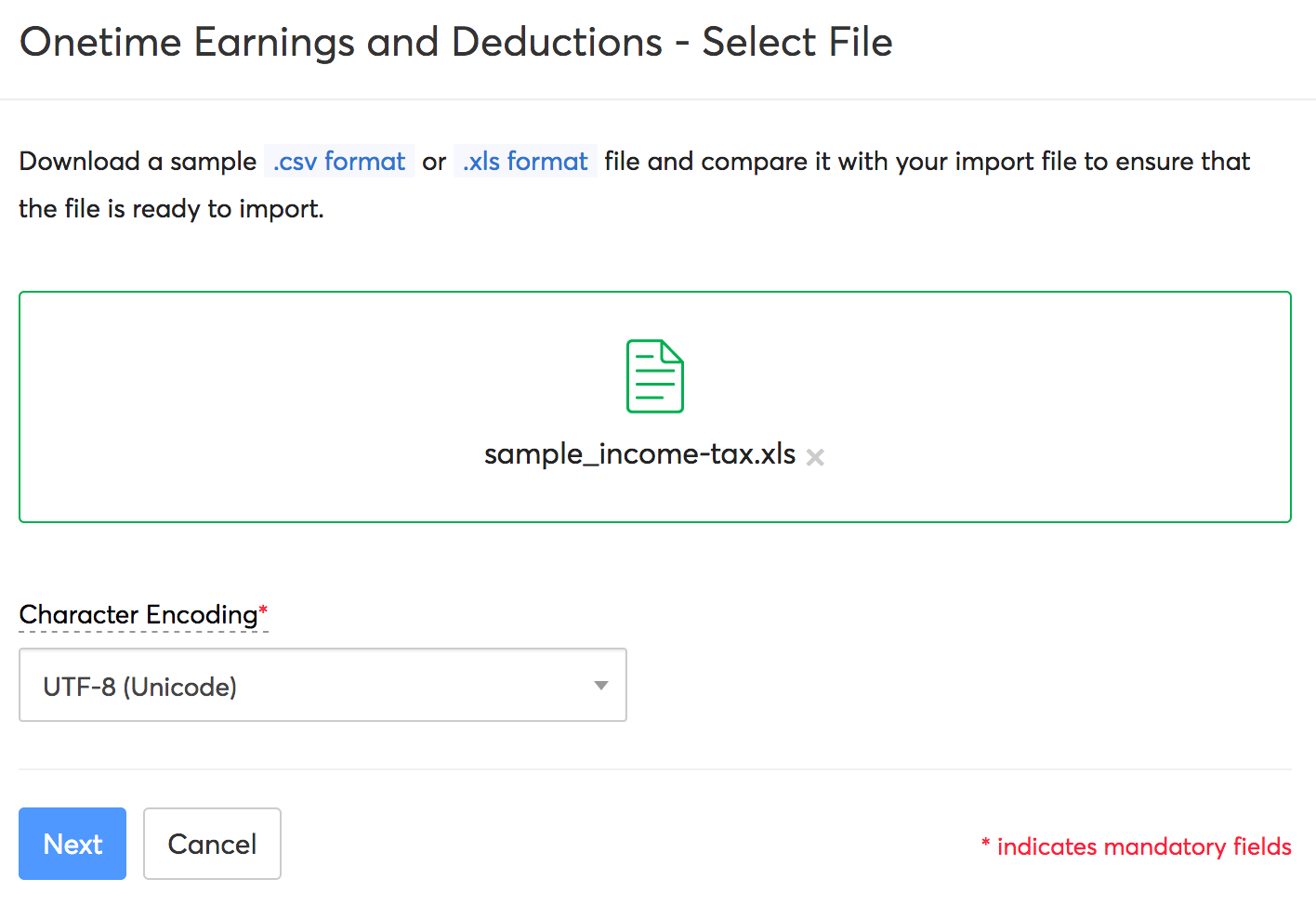

- Upload your CSV or XLS file containing Employee Number, Income Tax and Income Tax Overridden Reason. You can view a sample file to make sure that you’ve entered the data in the correct format.

- Select the Character Encoding.

- Click Next.

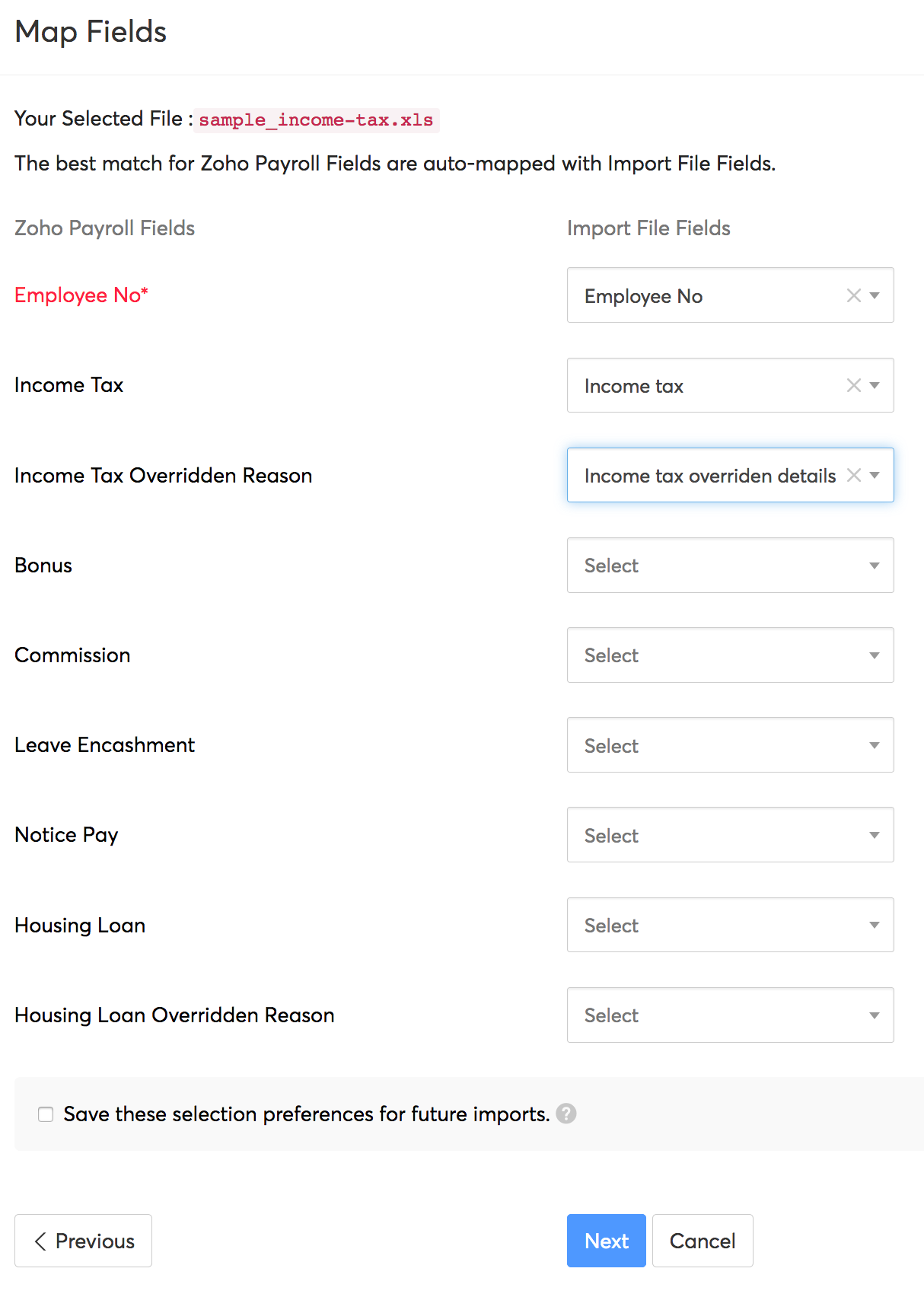

- Map the Zoho Payroll fields with the columns in your import file.

- Click Next.

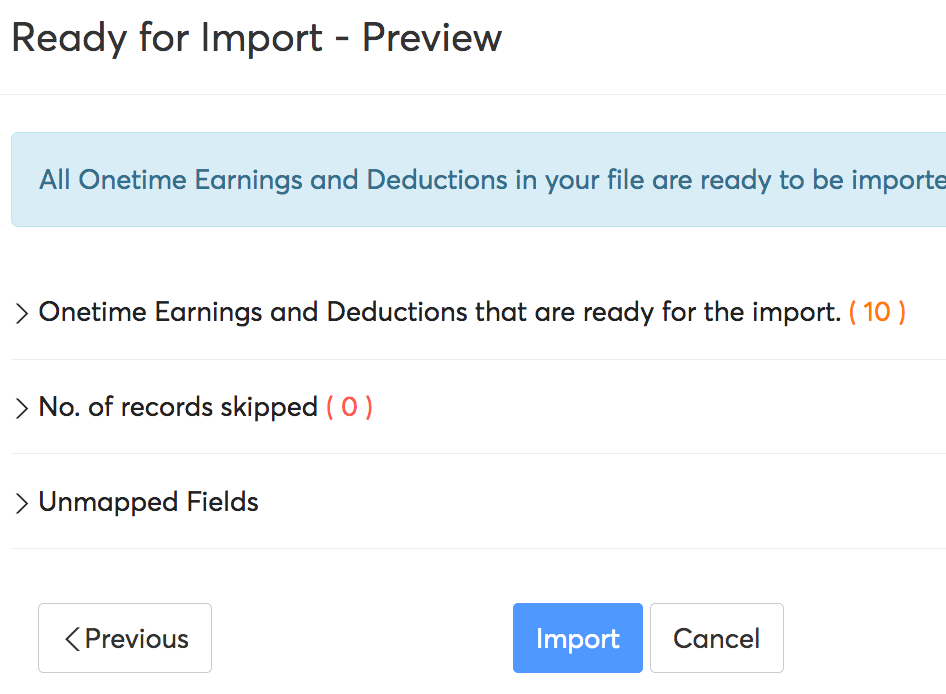

- View the import preview and click the Import button.

- Click Apply Changes in the payroll draft page.

Income tax amount for the employees will be updated in the pay run.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!