Guidelines to Submit Investment Proofs in Zoho Payroll

During every financial year, you can declare investments to reduce the taxable income on your salary. You have to submit proofs for all the investments you have declared, so that your employer can match the declared investments along with the submitted proofs and compute the true-up of taxes.

Based on the investments declared and submitted proofs, the following outcomes are possible.

- If the value of declared investments is equal to the value of proofs submitted, there won’t be any change in your taxable salary from the time you declared your investments.

- If the value of declared investments is greater than the value of proofs submitted, then your taxable income increases. You have to pay more taxes.

- If the value of declared investments is less than the value of proofs submitted, then your taxable income decreases. You can reclaim the additional taxes paid through IT returns.

- If you do not declare any investments and do not submit any proof, only the Government mandated standard exemptions will be deducted from your salary. The remaining income will be taxed as it is.

Things to keep in mind

- Investment Proofs (POI) can be submitted only when the POI submission window is opened by your employer. You will receive an email and a notification in the Home tab inside the self-service portal

- You can view the declared investments and proofs and also respond to comments made by your payroll admin using our mobile app.

Steps to be followed

After your employer has unlocked the POI submission, you can log in to your Zoho Payroll portal and submit your proof of investments. To submit:

- Navigate to the Investments module in the left side bar.

- Select Submit proofs.

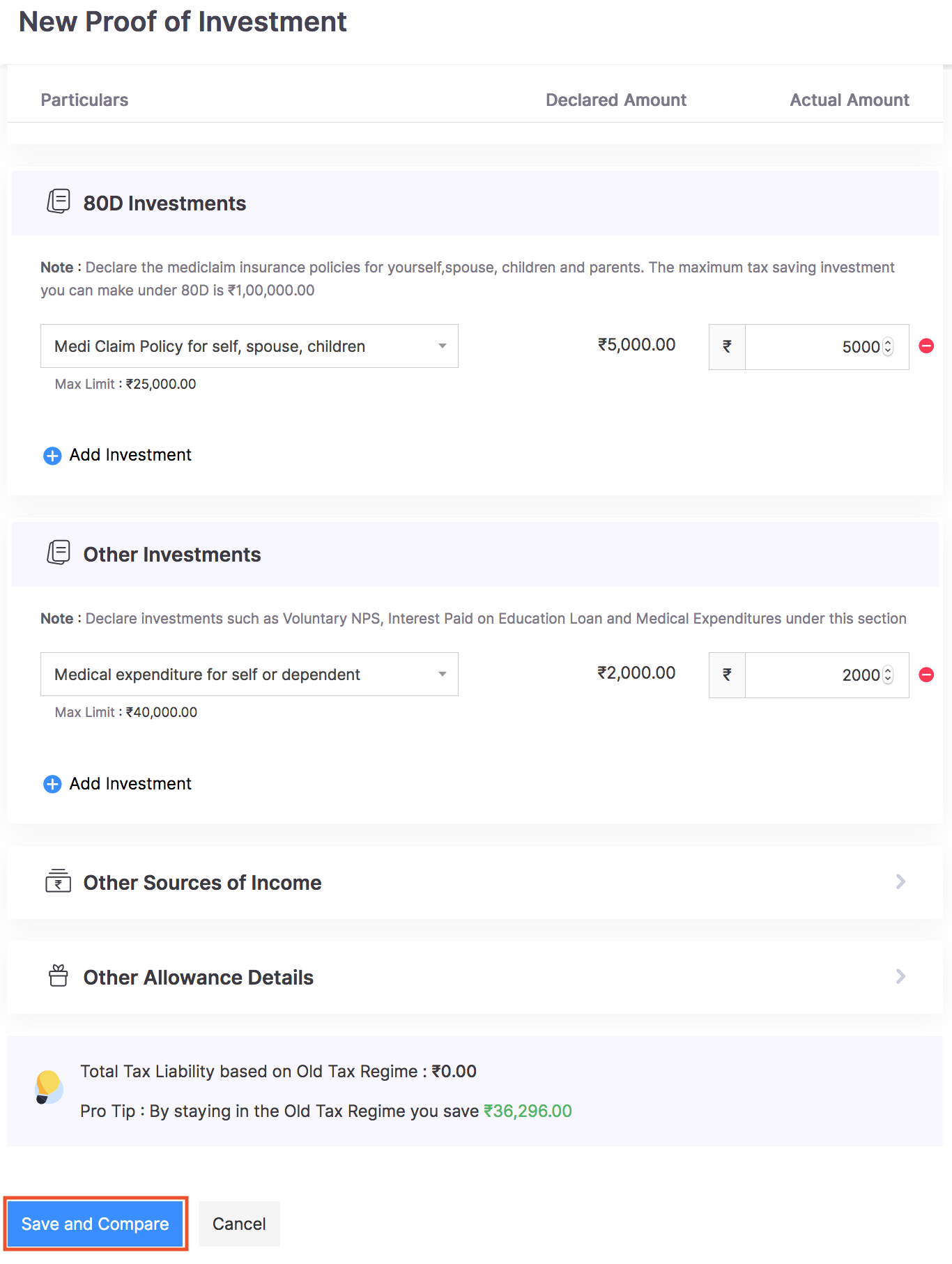

- Enter the actual amount invested for each investment, provided you have valid proofs.

- Add new investments if needed.

- To check the total tax liability, click Compute Tax.

- Click Save and Compare.

- In the Overall Tax Summary page, attach the proofs by clicking the Attach icon.

- Add comments if you need to convey something about your investments to your employer or approver.

- Review all the details and check the acknowledgment.

- Click Submit.

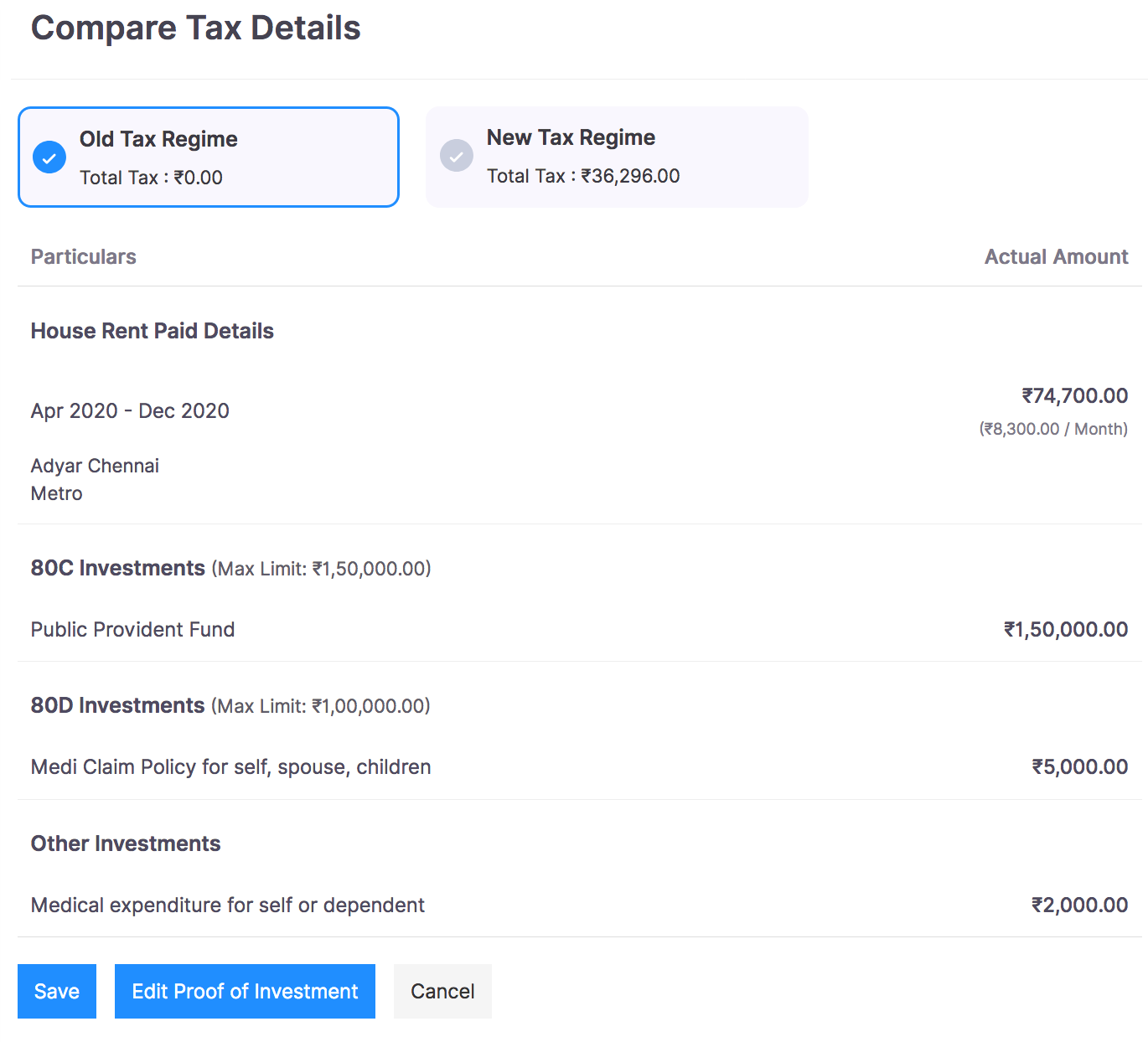

If you want to switch tax regimes, you can do so before your employer runs the first payroll for the financial year provided, the POI is unlocked. Else, you can do it at the time of filing ITR.

- Go to the Investments tab.

- Select Proof of Investments.

- Select the More icon next to Edit Declaration and select Change Tax Regime.

- You will be redirected to the Tax Comparison page. Here, you can evaluate the tax liability under each regime and select the desired regime.

- Next, click Save.

- Review all the details in the Overall Tax Summary page and check the acknowledgment.

- Click Submit.

Editing the submitted Proof of Investment (POI)

- You can withdraw, edit, and resubmit the proof of investments provided your payroll admin has not locked or approved it.

- Investment proof once submitted, cannot be edited without withdrawing it.

- To withdraw your investment proofs, go to the summary page and click Withdraw Proof of Investments. In the confirmation pop-up box, click Yes.

- Once the submitted proofs are withdrawn, click Edit Proof Of Investment to make changes.

- Click Save.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!