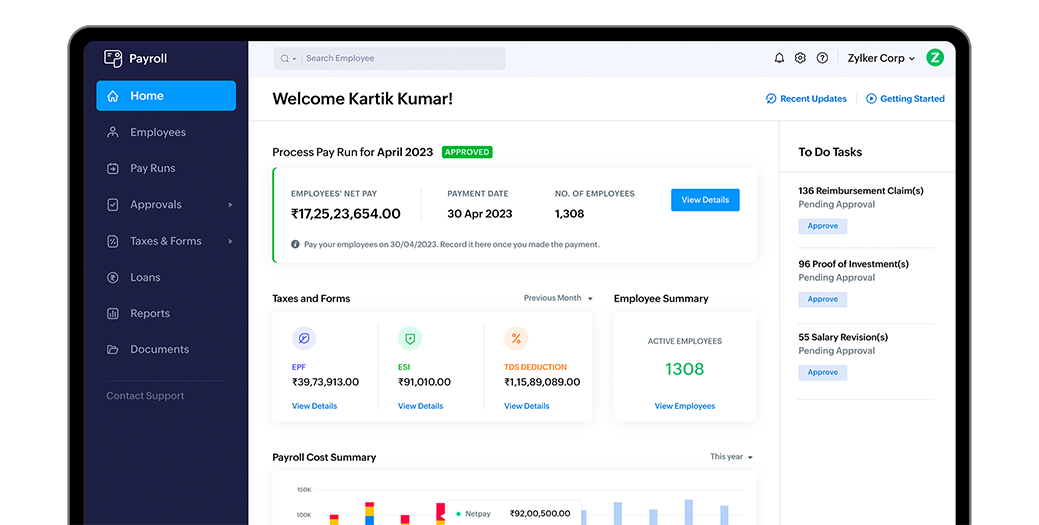

Free Payslip Generator

by Zoho PayrollFree Payslip Generator

With Zoho Payroll, create top-notch payslips for your employees right away! Easy to use and customisable, this free tool will make payroll smoother for you.

What is a payslip and who receives it ?

A salary slip or payslip is a document containing a detailed list of the various components of your salary along with the specific details of employment. It is issued every month by an employer either in the form of a printed hard copy or an electronic copy.

A salary slip is only available to salaried employees and your employer is responsible for providing you a copy of your payslip every month.

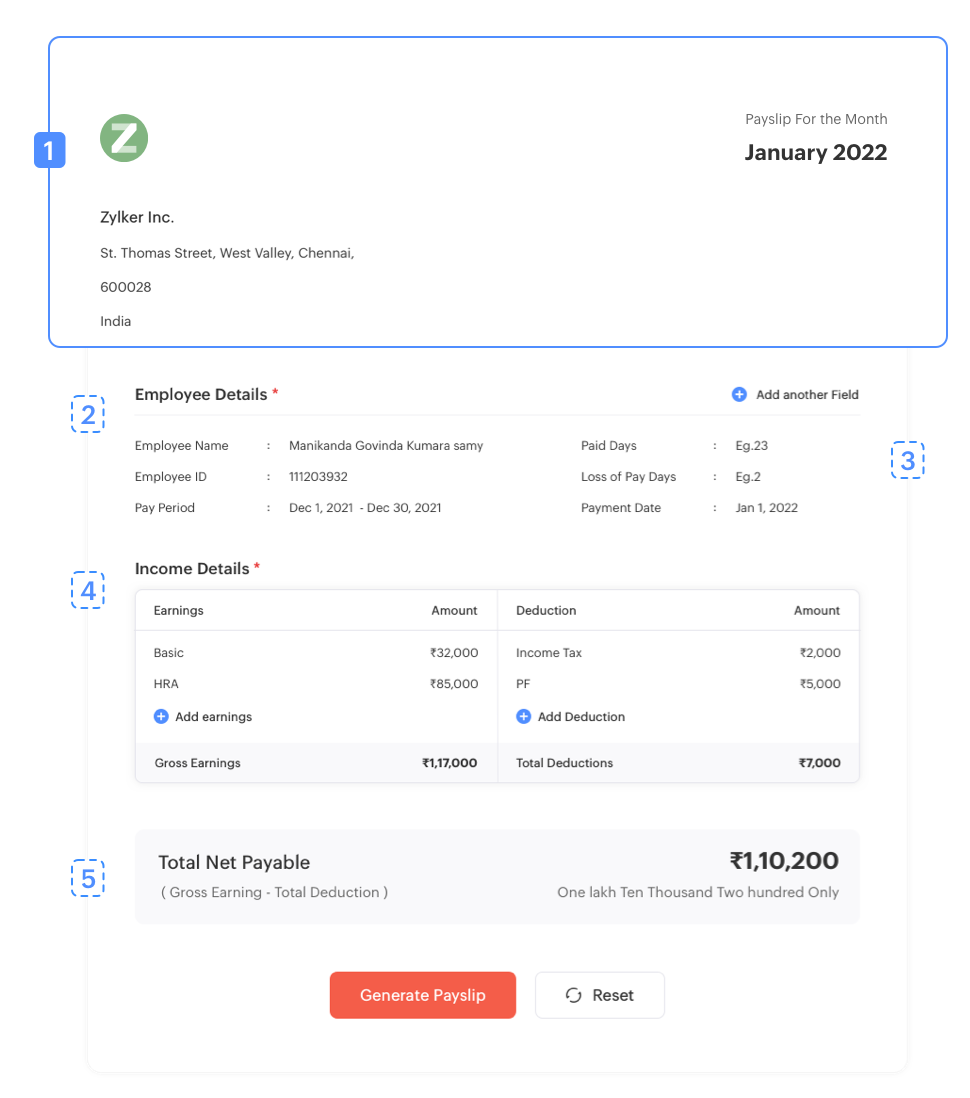

How can you generate payslips with this tool ?

As the name suggests, using the free payslip generator, you will be able to create and disburse payslips to all your employees. The process of generating a payslip is simplified here by following these four steps.

Step 1

Fill in the basic details about your company i.e. the name, logo, address, etc.,

Step 2

Enter your employee's details i.e. the name, ID number, designation, PAN, bank account number, etc.,

Step 3

Add the income details i.e. Employee's UAN, pay period, earnings, deductions, etc.,

Step 4

Select Generate Payslip to download and preview it.

You have now successfully generated a payslip for your employee.

Payslip Format

A valid payslip usually has the following information:

| 1 | Company Name, Logo , Address, Payslip Month, and Year | |

| 2 | Employee Name, Employee ID, Pay Period | |

| 3 | Total Paid Days, Loss of Pay (LOP) Days, Payment Date | |

| 4 | List of Earnings and Deductions | |

| 5 | Employee's Gross and Net Income |

What are the components of a Payslip?

The two major components of a Payslip are:

| Basic salary | This is the primary component of your employee's salary and also acts as the foundation upon which other components are calculated. For eg: 12% of the basic pay is usually the PF. |

| Dearness Allowance (DA) | Calculated as a percentage of your basic pay, DA is given to offset the impact of inflation. It is completely taxable and need to be declared while ITR filing. This payslip component is typically only for government employees. |

| House Rent Allowance (HRA) | It is an allowance to help people pay their house rent. The amount of HRA depends on the location and ranges between 40%-50% of basic pay. You can claim a part of the HRA as a tax deduction, and need to be declared while ITR filing. |

| Performance and Special Allowance | This is given to encourage employees for a better performance. This component is completely taxable. |

| Other Allowance | This comprises the various additional allowances paid by an employer for any reason. An employer may categorize such allowances under a specific head or group them as 'Other Allowances' |

| Employee Provident Fund (EPF) | This comprises a compulsory deduction in your salary slip. This component of your salary slip is at least 12% of your basic salary and diverted to an EPF account and is exempt from tax. |

| Professional Tax | This payslip component is levied on all individuals, including the salaried, professionals and traders who have an income. It is levied in some states only and calculated on the basis of an individual's tax slab. |

| Tax Deductible at Source(TDS) | It refers to the amount of tax deducted by your employer on behalf of Income Tax department. You can reduce TDS by investing in tax-saving schemes and submitting the appropriate documents to your employer. |

What is the significance of a Payslip?

Income Tax Planning

A salary typically comprises of various components such as Basic, HRA etc which might have different tax treatments. Knowing the value of separate components can form the basis for maximizing your income tax savings for the applicable financial year.

Proof of employment

This document serves as a legal proof of employment. While applying for visa or to executive programs at various universities, you may have to submit copies of your payslip, as a proof of your last drawn salary and designation.

To avail loans/ credit card

Your payslip contains details of your monthly income which is a key factor that determines your ability to meet your debt obligations. Thus, your salary slip is important while applying for credit card, loan, mortgage and other borrowings.

For seeking further employment

Knowledge about the various components of your salary slip can help you assess other job offers. Moreover, it forms the basis of salary negotiations when applying for a new job.

Frequently Asked Questions

What is the Payslip Generator tool?

The Payslip Generator is a free tool developed by Zoho to help organisations create and share payslips with their employees. Employers can simply add the relevant components of an employee's salary to an existing template and create a payslip.

Are the payslips generated using Payslip Generator statutory-compliant?

Yes. According to the statutory compliance terms in India, a payslip must contain:

- Organisation's information

- Employee's basic information

- Pay Period

- Gross pay

- Salary components

- Deductions

- Net Pay

- Payment Date

Do I need to install any software to generate the payslips?

No, you need not install any software to generate a payslip. This is a completely free, cloud-based tool to create and share payslips with your employees.

Is it possible to hide certain components in the payslip?

No, there is no option to hide a salary component in the payslip. However, you can choose the specific components you want to add to the payslip or delete the components that you want to hide before you generate the payslip.

Can I generate payslips for multiple pay periods at a time with the same components?

No, you cannot generate payslips for multiple pay periods. You need to add the components individually for each pay period and downloads payslips separately.

How do I get help to use the Payslip Generator tool?

If you need any assistance in using the payslip generator tool, drop us an email at support@�zohopayroll.com. We will reach out to you and help you with your queries.

Are the data entered in Payslip Generator secure?

Yes, your data will be secure as Zoho follows a No-Adjunct Surveillance policy. The data you enter will not be stored anywhere and will not be shared with any third parties.