- HOME

- Taxes and compliance

- How to check an income tax refund status for 2023-24

How to check an income tax refund status for 2023-24

Each year taxpayers end up paying excess income tax to the government against the tax required to be paid by them. This could be because the tax deducted at the source, or the advance tax paid by them could be higher than the actual amount. To straighten things out, the Income Tax Department of India issues tax refunds of excess tax paid by the assessee.

Read this article to understand what an ITR refund is, how to check an income tax refund status, and more.

What is an income tax refund?

When a person pays more income tax than they are liable for in a financial year, they can request a refund on the excess tax paid. This income tax refund amount is calculated as follows:

Income tax refund = Total tax paid - Tax payable by the assessee

Assume Mr. Gupta paid ₹3 lakh as an advance tax during the financial year. At the end of the financial year, he learns his tax liability is only ₹2 lakh. He can request a refund by filing an income tax return (ITR). If the assessing officer approves his request, the excess tax amount ₹1 lakh will be credited to Gupta's pre-validated bank account.

The tax department of India has issued income tax refunds worth ₹1.19 lakh crore to taxpayers between the 1st of April and 8th of September of 2022.

The following taxpayers are eligible to claim an income tax refund:

Assessees who paid more advance tax or self-assessment tax than they're required to pay as per the regular assessment.

Individuals whose tax deducted at source (TDS) is higher than the actual tax liability.

Taxpayers with undeclared investments that offer tax benefits.

People taxed twice for having income from a foreign country.

- Those who erroneously paid more tax on income than they are liable for.

If you fall under any of the above categories and you have filed ITR using the correct ITR form, you are eligible for an income tax refund. After 10 days of filing returns, the IT department usually allows taxpayers to track their income tax refund status.

NOTE: Taxpayers can claim an income tax refund only by filling a return of income within the time limit prescribed by the government.

How to check an income tax refund status

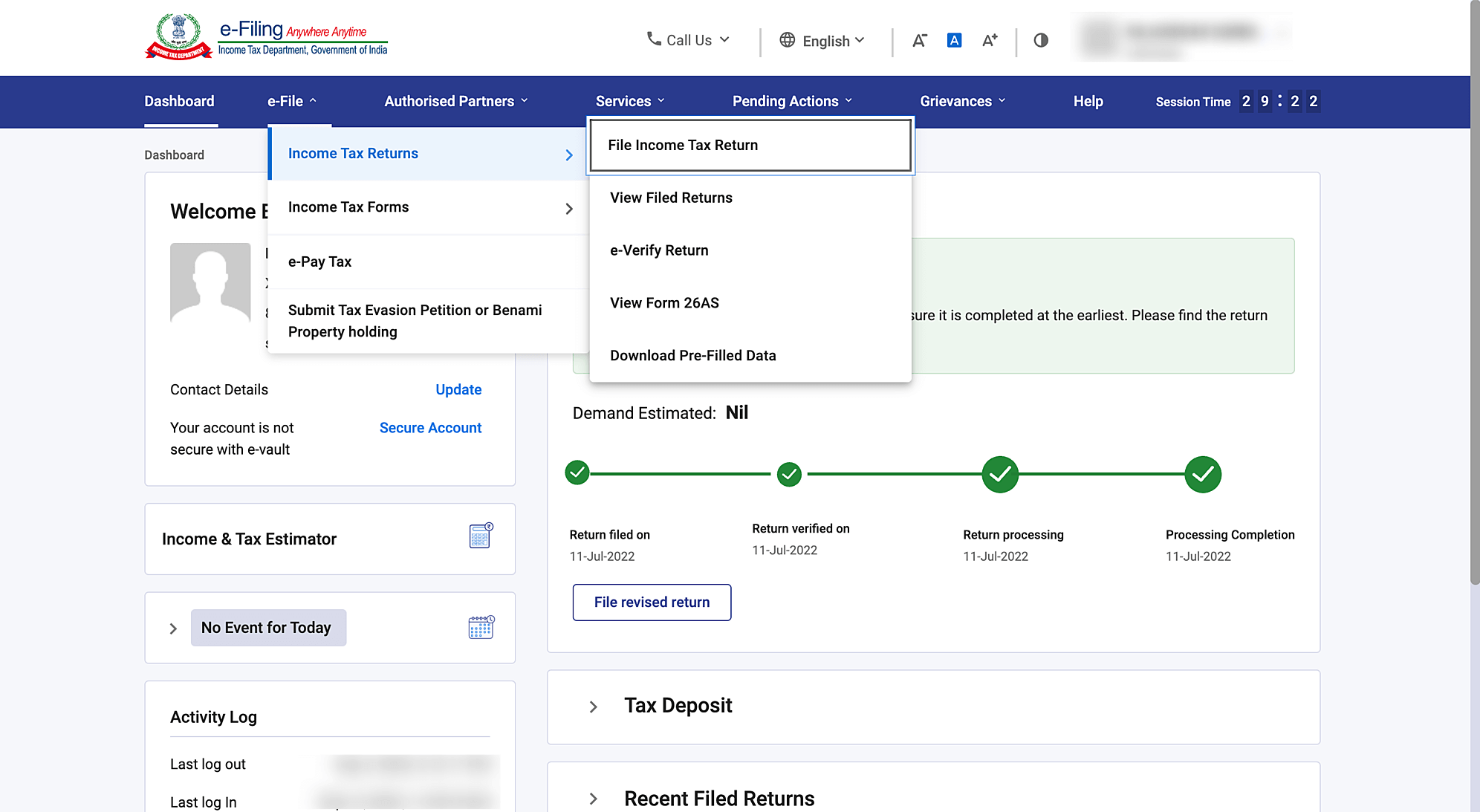

There's more than one way to track your ITR refund status. The commonly used method is logging into the income tax online portal and checking the status. Here's how you can do that:

- Visit the income tax e-filling portal and login using your PAN or other user ID and password. You will be directed to your dashboard.

- Go to e-File on the task bar and click View Filed Returns under Income Tax Returns.

- Go to the recently filed returns section and click View Details. The status of your ITR refund will be displayed along with the ITR acknowledgement number.

You can also track the income tax refund status using your PAN on the tax information network administered by the National Securities Depository Limited (NSDL).

- Go to the tax information network website's refund status page.

- Select Proceed under the Taxpayer Refund (PAN) column.

- You will be taken to the Refund Tracking page. Enter your PAN ID, assessment year (AY), and captcha.

- Once done, click Proceed. The status of your income tax refund will be displayed on screen.

Different types of income tax refund statuses

| Income tax refund status | Meaning |

| ITR filing not done | You have not filed returns or you filed for the incorrect assessment year. Check your ITR's year and file a revised return. |

| ITR processed with no demand/refund | Your ITR was processed successfully and you're not eligible for a refund. |

| ITR processed and refund paid | Your ITR was approved and the refund amount was credited to the pre-validated bank account. |

| ITR is under processing | Your returns were not processed yet. The IT department takes up to 60 days to process a return. |

| Defective return u/s 139(9) | The IT department rejected your return because you incorrectly filed it. You'll receive a notice from the assessing officer asking you to rectify the defects. |

| Return processed, but not e-verified | You submitted your ITR and forgot to e-verify it. The ITR refund will be processed only if you e-verify your returns. |

| Refund failure | You did not pre-validate your bank account or provided incorrect bank details. Log in to the e-filling portal, update your correct bank details, and pre-validate your bank account. Then, request a Refund Reissue. |

| ITR processed, tax demand determined | The IT department rejected your refund request and determined a tax payable from your side |

Interest on income tax refunds

If the refund processing is delayed by the IT department, the government should pay interest on the refund amount under few circumstances. As per Section 244A of the Income Tax Act, if the refund amount is more than 10% of the total tax paid, then the taxpayer is eligible for interest on the delayed refund.

If a return of income is filed before the due date, interest of 0.5% will be paid every month from the 1st of April of that AY to the date on which the refund is granted.

In any other case, an interest amount will be paid from the date of the furnishing of the return to the date on which the refund is granted.

Appendix

Advance tax

As the name suggests, it is the tax paid in advance for income earned during a financial year instead of at the end of the year. People with income from more than one source whose tax liability exceeds ₹10,000 after TDS can opt to pay tax in advance. Advance tax should be paid in four installments.

| Percentage of advance tax to be paid | Due date |

| 15% | 15th of June |

| 45% | 15th of September |

| 75% | 15th of December |

| 100% | 15th of March |

Learn everything you need to know about advance tax.

Self-assessment tax

This is an income tax calculated and deposited to the government by the assessee on their own. Individuals filing this tax are required to consolidate their earnings from various sources, avail exemptions, if any, and adjust the amount with losses and deductions. They're required to deposit the tax payable online using Challan No./ITNS 280 or at authorized banks. The payment should be made before filling in an income tax return.