- HOME

- Payroll administration

- Transport allowance - Definition, calculation, and exemption rules

Transport allowance - Definition, calculation, and exemption rules

Transport allowance is a salary component provided to employees in India to cover their commuting costs to and from the workplace. This allowance can be a fixed amount or based on the actual transportation expenses incurred.

In recent years, the taxability and tax exemption rules for transport allowances have changed. This article will help you understand the meaning of transport allowance, its tax treatment, and calculation methods so you can ensure accurate payroll processing and compliance.

Transport allowance meaning

A transport allowance helps employees cover the costs of commuting from home to the office. It is usually offered as a fixed salary and forms part of the employee’s Cost to Company (CTC).

This allowance is generally given by employers when they do not offer transportation services. It is also provided to those working in the transportation industry to help with personal expenses incurred while operating transport vehicles.

Organisations that offer transport allowance, must include this allowance in the employee’s salary slips.

Transport allowance calculation

Transport allowance can be set as a fixed amount or calculated as a percentage of the basic salary, with no restrictions on the maximum limit. You can determine the transport allowance for your employees based on the following factors:

- Distance between the employee’s home and the office

- Transportation expenses

- Overall salary package

Pro-tip: Automate transport allowance and other salary calculations with cloud-based payroll software like Zoho Payroll.

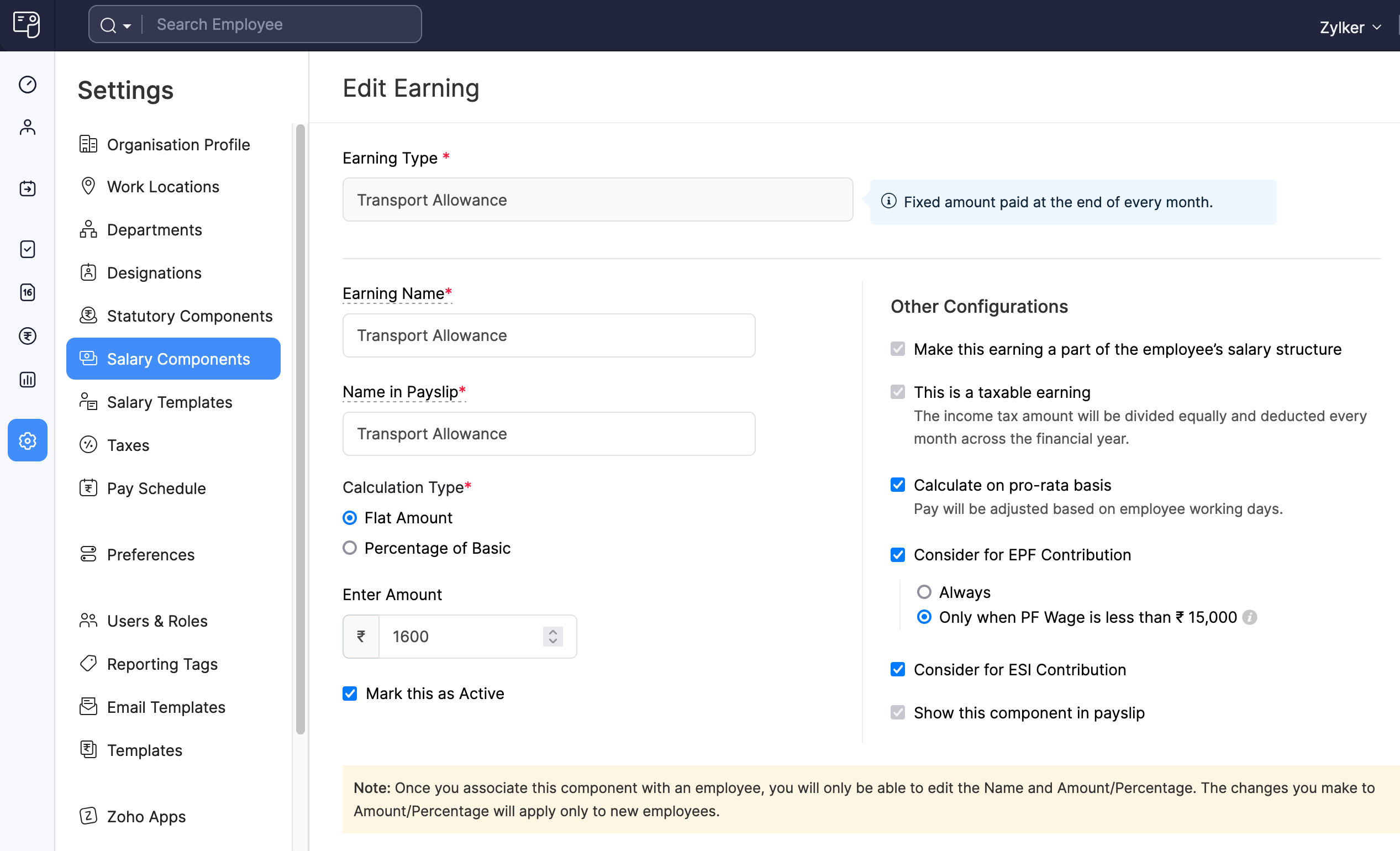

Transport allowance calculation in Zoho Payroll

Is transport allowance taxable?

Transport allowance is fully taxable and is included in the employee's taxable income. However, differently-abled employees can claim tax exemptions up to a specified limit.

This exemption does not apply to employees who receive free transport from their employer or those who are reimbursed for vehicle maintenance expenses.

Taxability of transport allowance: What the government says

Previously, all employees were eligible to claim a tax exemption of ₹19,200 annually on transport allowance.

Starting from the financial year 2018-2019, the Indian government discontinued this exemption by merging the tax exemptions for transport allowance and medical allowance into a standard deduction.

Under this standard deduction, employees can now claim a tax exemption of up to ₹50,000 in the old tax regime and ₹75,000 in the new tax regime without needing to submit any bills or documents related to transport or medical expenses.

Transport allowance tax calculation for general employees

Consider an example of an employee at Zylker Ltd. Assume the employee receives an annual basic salary of ₹ 4,00,000, stays at his own house and receives a house rent allowance of ₹ 1,50,000, and an annual transport allowance of ₹25,000.

Here’s how the taxable portion of his salary is calculated in the old tax regime:

Taxable income = (Basic salary + house rent allowance + transport allowance) - standard deduction

- Annual taxable income = (₹4,00,000 + ₹1,50,000 + ₹25,000) - ₹50,000

- Annual taxable income = ₹5,75,000 - 50,000

- Annual taxable income = ₹5,25,000

Depending on the employee's income tax bracket, the applicable tax amount must be deducted from their gross salary.

Transport allowance exemption for differently-abled employees

Employees with visual or hearing impairments, or those with physical disabilities affecting their legs, can claim tax exemption on transport allowance, in addition to standard deduction.

They can claim a transport allowance exemption of ₹3,200 per month, amounting to ₹38,400 annually.

This exemption is available under both the old and new tax regimes, providing financial relief to these employees regardless of the regime they choose.

Transport allowance tax calculation for differently-abled employees

Assume a differently-abled employee joins a company and receives a monthly transport allowance of ₹4,000. According to income tax rules, the annual exemption limit is ₹3,200. Here is how the employee’s taxable amount will be determined:

- Monthly transport allowance = ₹4,000

- Exemption limit = ₹3,200

- Amount exceeding the exemption = ₹800 per month

Therefore, the remaining transport allowance of ₹800 per month will be added to the employee’s taxable income and taxed according to the slab they fall under.

The way forward

Understanding the intricacies of transport allowance and its tax implications is essential for accurate payroll processing and compliance. Whether you are following the old tax regime or the new one, ensuring your employees receive the correct transport allowance exemptions is crucial.

Using an efficient payroll management system like Zoho Payroll can simplify this process. Zoho Payroll helps you automate the calculation of transport allowance, track exemptions, and ensure compliance with the latest tax regulations.