- HOME

- Regulatory compliance

- PCI compliance: An overview

PCI compliance: An overview

PCI DSS or the Payment Card Industry Data Security Standard is a set of security policies that protect credit and payment card data. It was established by the five major card networks: Visa, Mastercard, JCB, Discover Financial Services, and American Express. It is designed to protect payment card data and transaction information throughout the payment lifecycle.

PCI DSS ensures the safety of cardholder information, such as the PAN, the cardholder name, the card expiration date, and the service code. It also protects sensitive authentication data, such as magnetic swipe information, CAV2, CVC2, CVV2, CID, and PIN blocks.

The PCI DSS is regulated by the Payment Card Industry Security Standards Council, also known as the PCI SSC. Companies involved in the storage, processing, or transmission of card information are required to be compliant with PCI standards.

PCI compliance: An overview

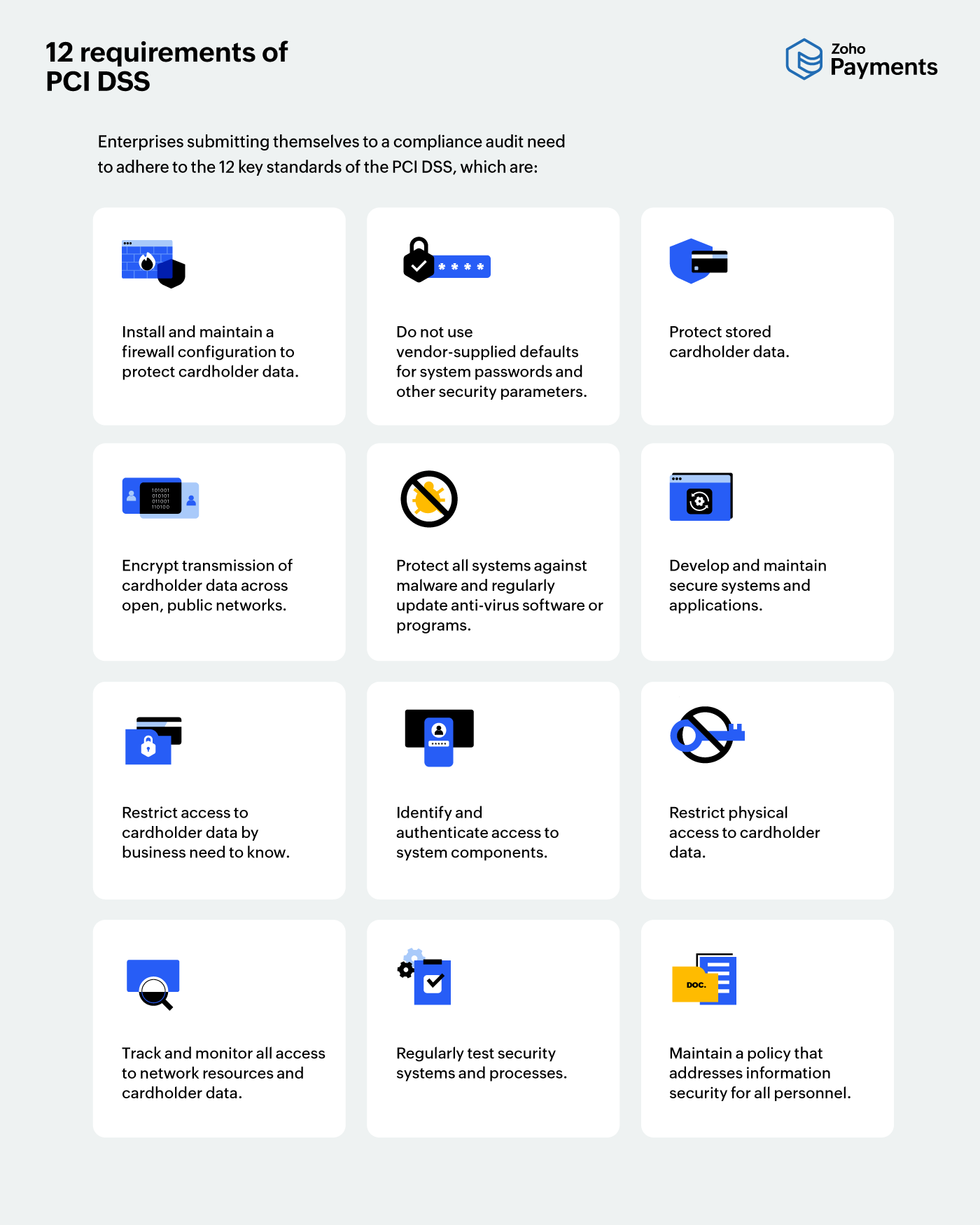

12 requirements of PCI DSS

12 Requirements of PCI DSS Compliance

12 Requirements of PCI DSS Compliance

PCI compliance levels

To obtain the PCI DSS certification, companies must submit themselves to a compliance audit of the PCI DSS and its 12 requirements. For this purpose, enterprises are categorized into PCI compliance levels either as merchants or service providers based on the volume of transactions processed annually.

Merchant levels and validation requirements

PCI Level 1: Businesses with over 6 million transactions processed per year fall under PCI Level 1.

Validation requirements: An annual report on compliance (ROC) by a qualified security assessor (QSA) or internal auditor (if signed by an officer with PCI SSC Internal Security Assessor certification), and a quarterly network scan by an approved scanning vendor (ASV).

PCI Level 2: Businesses with 1 to 6 million transactions processed per year fall under PCI Level 2.

Validation requirements: Taking up the Self-Assessment Questionnaire (SAQ) annually along with a quarterly network scan by an ASV.

PCI Level 3: Businesses with 20,000 to 1 million transactions processed per year fall under PCI Level 3.

Validation requirements: Quarterly network scan by an ASV, along with an annual SAQ.

PCI Level 4: Businesses with fewer than 20,000 transactions processed per year fall under PCI Level 4.

Validation requirements: Annual SAQ and a quarterly network scan by an ASV, if applicable.

Service provider levels and validation requirements

Level 1: Service providers processing over 300,000 Visa or Mastercard transactions annually.

Validation requirements: Annual ROC by a QSA or internal auditor if signed by an officer with ISA certification, and a quarterly network scan by an ASV.

Level 2: Service providers processing less than 300,000 Visa or Mastercard transactions annually.

Validation requirements: Annual SAQ along with a quarterly network scan by an ASV.

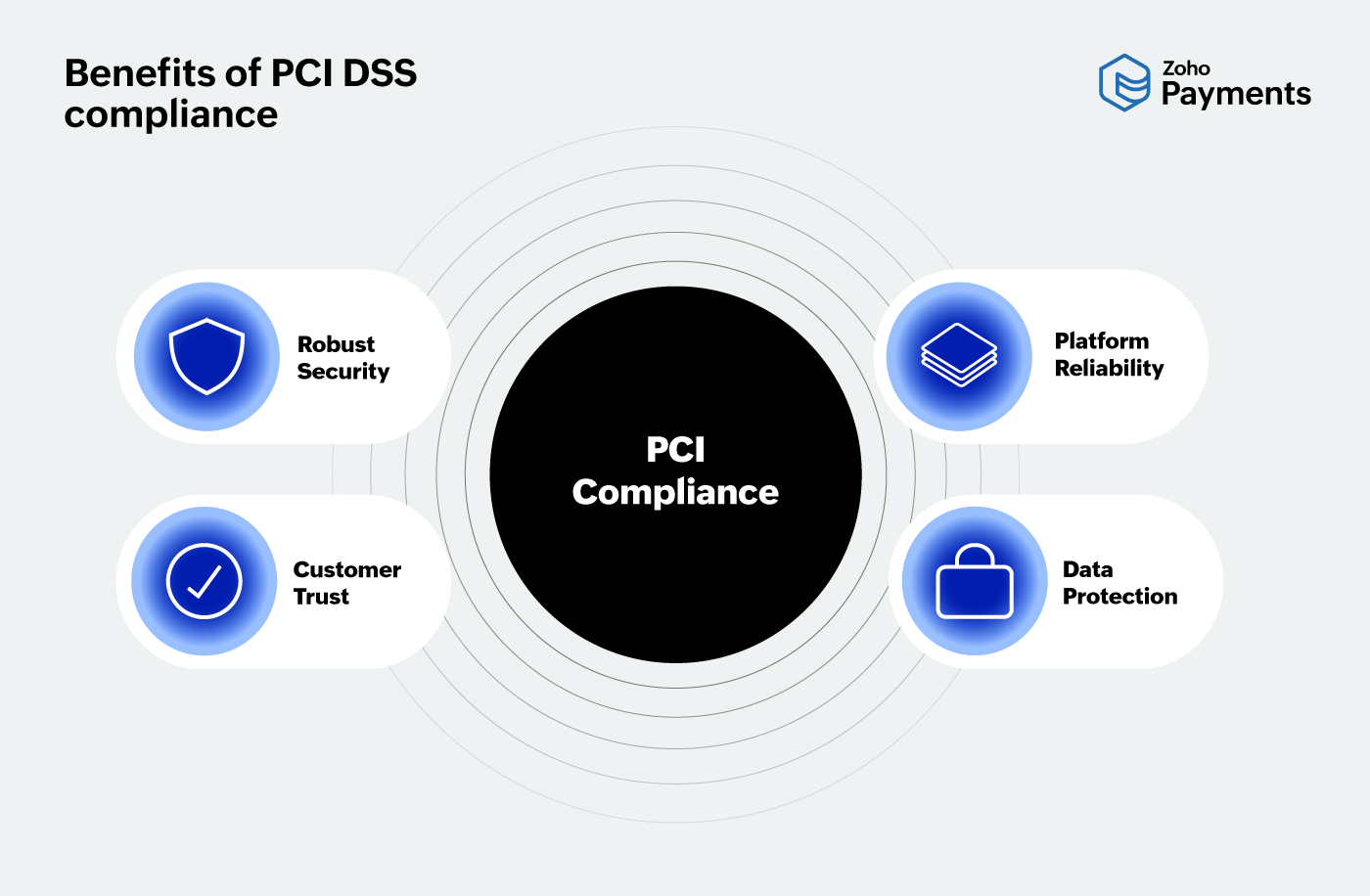

Benefits of PCI DSS compliance

As a merchant, selecting a PCI DSS compliant payment aggregator or payment service provider (PSP) is crucial for several reasons.

It ensures that the PSP follows stringent security protocols to protect sensitive cardholder data. This aids in reducing the risk of data breaches and cyberattacks, protecting both the merchants as well as the customers.

Compliant providers aid merchants in adhering to industry regulations and following mandatory compliance policies associated with businesses handling card payments.

PCI DSS compliance is a marker of quality and reliability, reassuring customers that their payment information is secure. This boosts the reputation and the overall security posture of the company.

In the event of a data breach, PCI DSS-compliant providers can limit the merchant's liability by exhibiting due diligence through adhering to compliance standards.

For instance, Zoho Payments stands at PCI DSS Level 1 compliance, adhering to the highest standards of data protection. It provides security and confidence to merchants using the platform by protecting sensitive cardholder information against data breaches and cyberattacks. Aligning with industry regulations aids merchants in improving compliance for their own businesses and enhances its trustworthiness in the long-term.

Benefits of PCI DSS Compliance

Conclusion

PCI DSS compliance is essential for protecting cardholder data, ensuring secure transactions, and maintaining customer trust. Compliance helps prevent data breaches and financial losses, reinforcing the security and reliability of payment systems. By adhering to PCI DSS requirements, organizations not only mitigate financial and reputational risks associated with data breaches but also foster trust among customers, ensuring their sensitive information is handled securely. This compliance framework plays a vital role in safeguarding the integrity and reliability of payment systems worldwide, promoting a secure environment for electronic payments.

Disclaimer

The information provided here is for general informational purposes only and should not be construed as legal or professional advice. Zoho Group does not warrant or guarantee the accuracy, completeness of the information in the article.