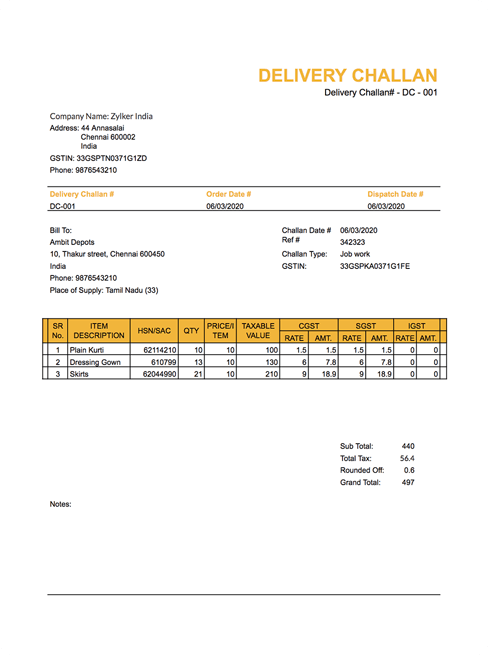

Free delivery challan Template

A delivery challan is a document which is generated when goods are transferred from one place to another, not necessarily for sale. It's mostly an internal document used to record the movement and confirm the delivery of the goods.

DOWNLOAD AS SPREADSHEET