Progress Invoicing

Fixed Asset Management

TDS Payments

Manage end-to-end accounting—from banking & e-invoicing to inventory & payroll with the best accounting software in India.

"Most versatile accounting software for every business need"

NAVEEDH V.V, CO-FOUNDER

"Backbone of my company's finance and operations"

SATYAN THUKRAL, CEO

"Best accounting software made for businesses worldwide"

VISHWADH KANDULA, CEO

I TRUST ZOHO BOOKS FOR MY BUSINESS

I TRUST ZOHO BOOKS FOR MY BUSINESS

"User-friendly, comprehensive, and highly compliant"

TARUN KUMAR JAIN, DIRECTOR

"One accounting solution for multiple outlets"

SHAMAL NAMBOLAN, DIRECTOR

"End-to-end accounting and inventory management made simple"

ABDURAHMAN, COMMERCIAL MANAGER

I TRUST ZOHO BOOKS FOR MY BUSINESS

I TRUST ZOHO BOOKS FOR MY BUSINESSGenerate e-invoices, e-Way bills, and delivery challans. Calculate liabilities automatically, and file tax returns directly.

Simplify online payments. Fetch bank feeds, categorize entries automatically, and reconcile them effortlessly.

Manage foreign transactions with our multi-currency feature. Apply exchange rates automatically or manually.

Work as a team, assign roles, permissions, and use customer and vendor portals for transparent, secure communication.

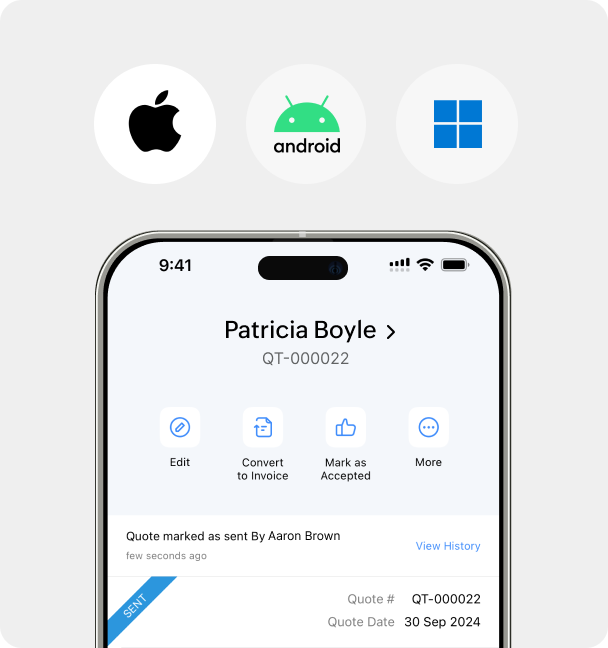

Whether you’re on the web, smartphone or desktop app, promptly send quotes right after meetings, track business expenses, log time, and view reports!

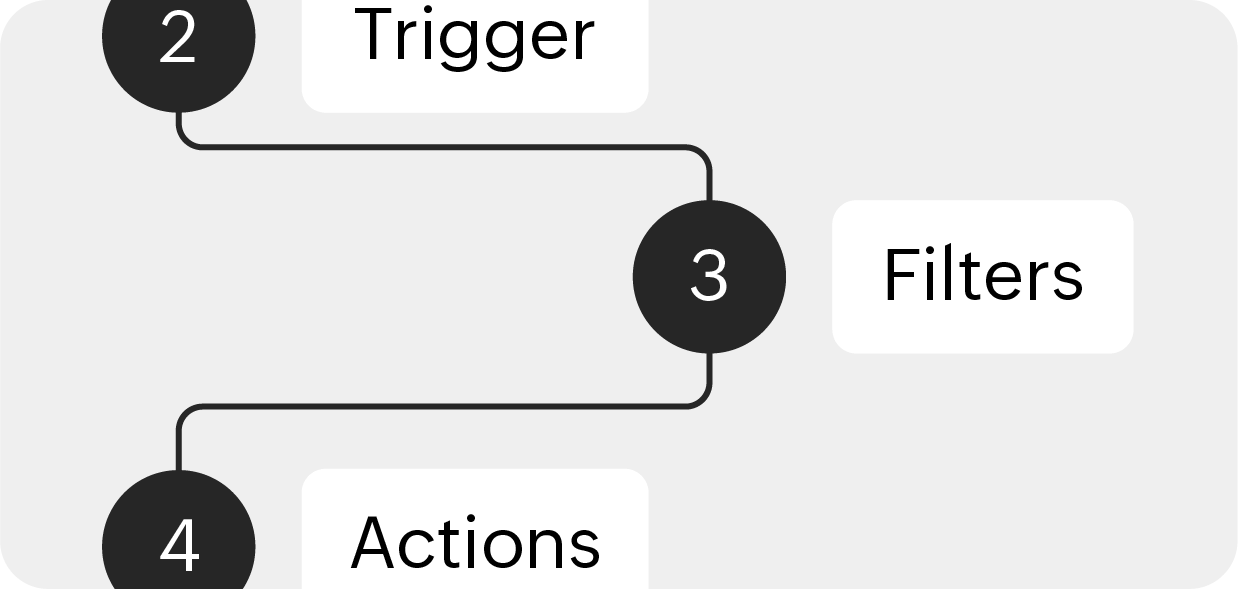

Trigger emails or notifications for reminders or alerts. Set recurring actions, schedules, and field updates.

Customize Zoho Books to suit your business with custom templates and fields. Get custom reports, too!

Get started with free accounting software for solopreneurs and micro businesses

Efficiently organize your transactions, accounts, reports, and books

Confidently take on projects, track your inventory, and handle purchases

Enhanced customization and automation to streamline business processes

Advanced accounting bundled with full-fledged inventory management

Gain deeper insights with advanced business intelligence capabilities

*Prices are exclusive of local taxes.

Get paid on time, track expenses, automate tasks, and make informed financial decisions.

Go global! Use multi-currency feature, advanced integrations, analytics, and customization.

At Zoho, we take pride in our perpetual efforts to surpass all expectations in providing security and privacy to our customers in this increasingly connected world.

Streamline the fiscal-year transition with accounting tips on receivables, payables, inventory, bank reconciliation, currency adjustments, GST filing, and more.

Expert insights and best practices. The e-invoicing mandate and its implications on your business. Discover how Zoho Books can simplify your transition to the new e-invoicing processes.

Find out how the three key features of e-invoicing, namely, IRN, DSC, and QR code define the uniqueness of an e-invoice.