Comprehensive accounting software for growing businesses

Experience sales tax automation with Zoho Books. Send invoices, generate 1099 reports, and manage expenses, projects, & inventory.

Migrate to Zoho Books

Now you can easily move from other accounting solutions to Zoho Books

Trusted by businesses and accountants worldwide

Zoho Books has been a life saver for Site Search & Select. The integration of Zoho Books with Zoho CRM and other Zoho One applications makes it a seamless platform for our financial and forecasting needs.

Michael A. Hudson

CEO, Site Search & Select

I switched from QuickBooks to Zoho Books because it's incredibly user-friendly. Zoho Books has simplified our financial processes, especially with features like inventory management integrated with CRM. I trust Zoho Books.

Mathew O'Brien

Founder, ECM MEDIA LLC

Switching to Zoho Books from QuickBooks truly steadied our ship. Their attentive updates and smooth handling of the transition deepened our trust and simplified our day-to-day operations.

Kim Morhardt

Co-founder, BoxDrop, USA

Engineered to Unlock Business Growth

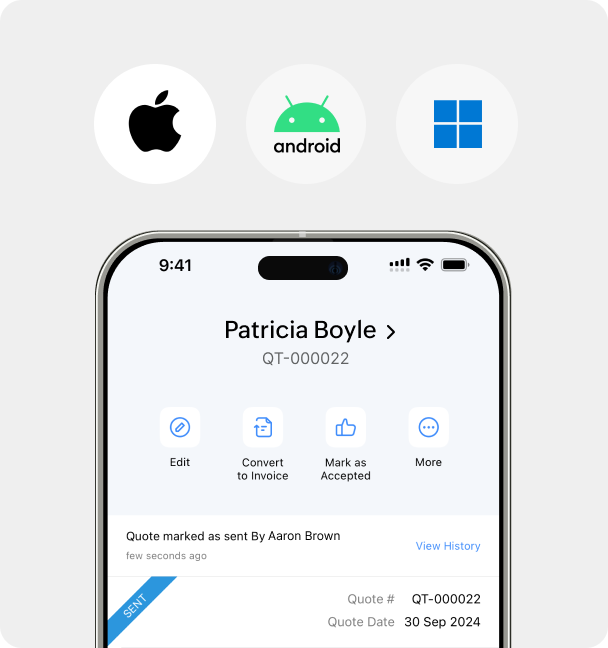

Accounting Across Devices

Whether you’re on the web, smartphone or desktop app, promptly send quotes right after meetings, track business expenses, log time, and view reports!

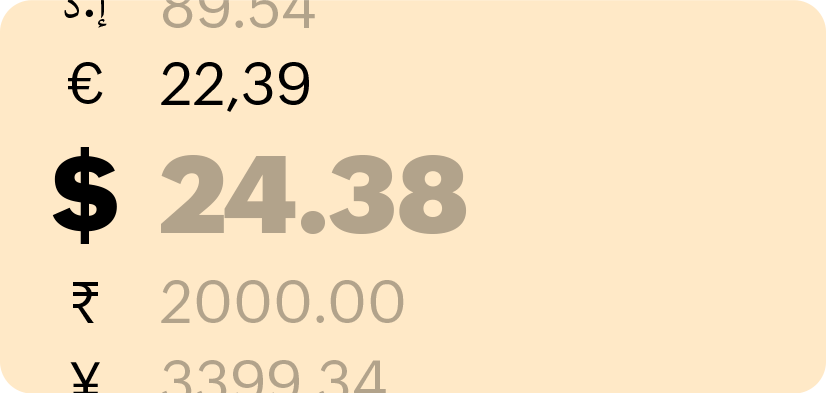

Sell globally

Manage foreign transactions with our multi-currency feature. Apply exchange rates automatically or manually.

Collaboration

Work as a team, assign roles, permissions, and use customer and vendor portals for transparent, secure communication.

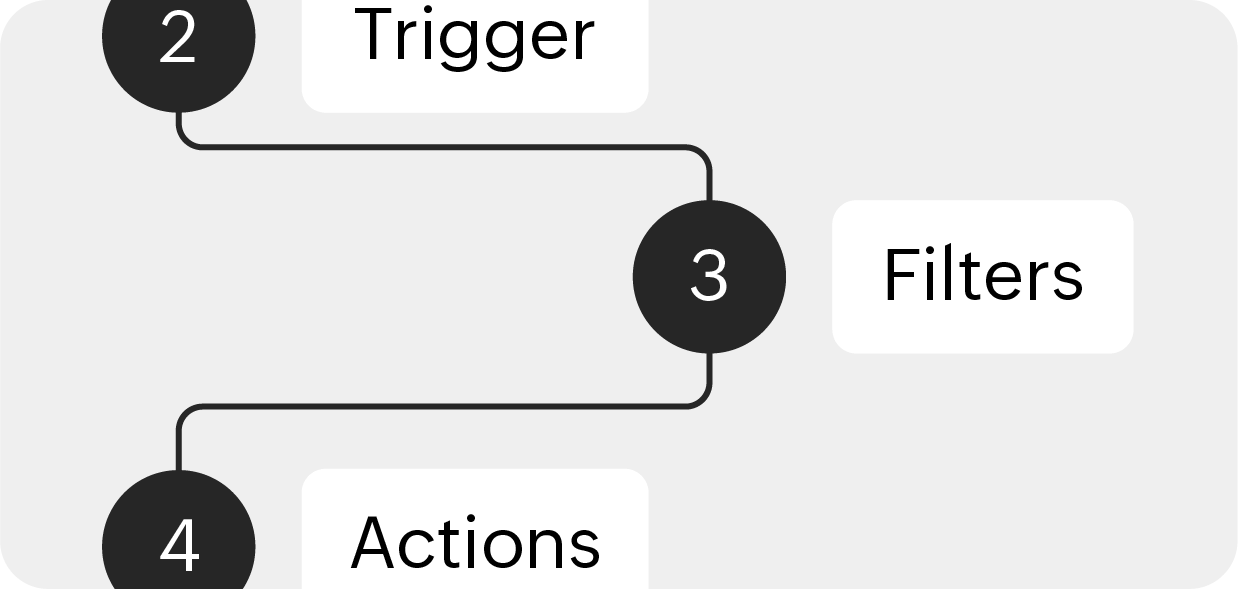

Automation

Trigger emails or notifications for reminders or alerts. Set recurring actions, schedules, and field updates.

Customization

Customize Zoho Books to suit your business with custom templates and fields. Get custom reports, too!

The Perfect Balance of Features and Affordability

FREE

Get started with free accounting software for solopreneurs and micro businesses

STANDARD

Efficiently organize your transactions, accounts, reports, and books

PROFESSIONAL

Confidently take on projects, track your inventory, and handle purchases

PREMIUM

Enhanced customization and automation to streamline business processes

ELITE

Advanced accounting bundled with full-fledged inventory management

ULTIMATE

Gain deeper insights with advanced business intelligence capabilities

*Prices are exclusive of local taxes.

An accounting solution for every need and every business

Connect and conquer

Orchestrate success connecting with the apps you love

Choose privacy.

Choose Zoho.

At Zoho, we take pride in our perpetual efforts to surpass all expectations in providing security and privacy to our customers in this increasingly connected world.

What's next

- Request a demo

- Join a free webinar

- Compare plans

- Migrate to Zoho Books

$70,000.00

$70,000.00