How do I handle changes in TDS rates in my Zoho Books organization when the Income Tax Department updates them?

During the annual Union Budget meeting, the government announces changes to the TDS rates for various categories. For example, the TDS rate for payments under sections 194DA, 194H, 194-IB, and 194M was reduced from 5% to 2% in 2024

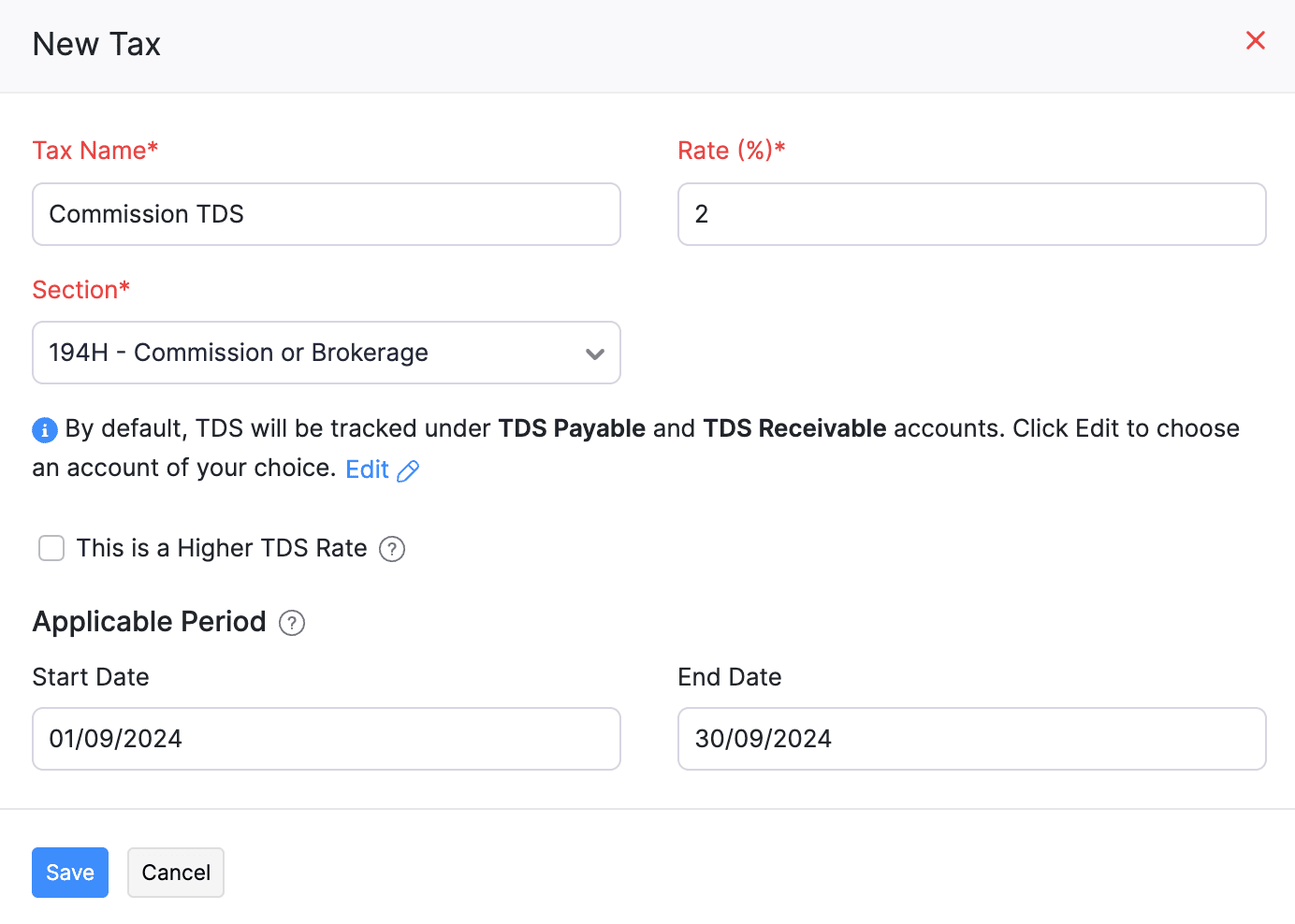

If the Income Tax Department updates the TDS rates, you can set a start date and an end date for the changed TDS taxes. By doing so, the TDS rate will expire after the specified end date, allowing you to create a new TDS rate with start and end dates that reflect the new rates specified by the government.

With the Effective Date field, users can specify start and end dates when creating TDS, TDS Surcharge, TDS CESS, and Group TDS. The TDS tax rate with an effective date will apply only to transactions within the specified date range.

Note:TDS rates with effective dates cannot be associated with Group TDS that does not have an effective date. For Group TDS with an effective date, the associated TDS rates must not start after or end before the Group TDS’s effective date.

To create a TDS rate with an effective date:

- Go to Sales on the left sidebar and select Invoices.

- Click + New to create a new invoice, or select the invoice to which you want to apply TDS rate and click Edit.

- Enter all the necessary details and scroll down to the Total section.

- Choose TDS and click Manage TDS from the Select a Tax dropdown.

- Click + New TDS Tax in the popup.

- Enter Tax Name, Rate, and select the Section.

- Check the This is a Higher TDS Rate option, if you’re adding a higher TDS rate and select a reason for it in the Reason for Higher TDS Rate dropdown.

- Select the Start Date and End Date applicable for the TDS rate under Applicable Period.

Note:You can specify only the End Date if you want to set an expiration period for a TDS rate.

- Click Save.

Once the applicable period ends, the status of the TDS rate will be marked as Expired.

Note:Similarly, you can create and apply TDS rates with effective date in other applicable modules.

Edit the Effective Date of a TDS Rate

Note: If you edit any fields other than the Start Date and End Date, a new TDS rate will be created.

To edit the effective date of a TDS rate:

- Go to Sales on the left sidebar, and select Invoices.

- Select the invoice that you want to edit and click Edit on the top bar.

- Scroll down to the total section and click Manage TDS from the dropdown next to TDS.

- Hover over the required TDS rate and click the Edit icon.

- Change the Start Date or the End Date according to your preference.

- Click Save.

The TDS rate will be saved with the start date and end date you’ve selected.

Note: The start and end dates of a TDS rate must fall within the applicable period.

Yes

Yes