Free GST Calculator

Zoho introduces a free GST calculator made just for small businesses! With this tool, you'll be able to calculate GST in

minutes without any complex math.

GST %

0%

Tax

Exclusive

0

Actual Amount

+

0

GST Amount

=

0

Total Amount

GST- Goods and Services Tax

GST or the Goods and Services Tax is an indirect tax that came into effect in India on the 1st of July, 2017. GST is

levied on goods and services and has replaced other indirect taxes that were in effect before it came into use.

How can you calculate GST with this tool?

With the free GST calculator, you can calculate the tax amount in three simple steps. The tool provides you with three

fields that have to be filled, and it calculates GST automatically based on what you fill in.

- Enter the price of the goods or services in the Amount field.

- Enter the percentage of GST, or the slab that the product comes under, in the GST % field.

- Choose if the price that you entered is inclusive or exclusive of tax in the Tax field.

- If the price you've entered is inclusive of tax, the tool automatically calculates, and displays the original price of the goods or service after subtracting the GST.

- If the price you've entered is exclusive of tax, the tool automatically calculates, and displays the gross price after adding the GST.

More on GST

GST was implemented primarily to bring uniformity to tax collection. Under the GST regime, tax is collected cumulatively at the final

stage of the production of goods or services. As per the GST 2.0 updates, there are four GST slabs—0%, 5%, 18%, and 40% with different

goods and services taxed at different rates. Additionally, some goods do not attract GST. Read more here.

There are four types of GST active in India. They are:

CGST - Central Goods and Services Tax, or CGST is collected by the central government for intra-state supply of goods

and services and is governed by the CGST act. CGST is charged along with SGST with both rates usually equal.

SGST - State Goods and Services Tax, or SGST is collected by the state government for intra-state supply of goods and

services and is governed by the SGST act. SGST is charged along with CGST with both rates usually equal.

IGST - Integrated Goods and Services Tax, or IGST is collected by the central government on inter-state supply of goods

and services as well as imports. The central government collects the IGST and then distributes it among the respective

states.

UTGST - Union Territory Goods and Services Tax, or UTGST is applicable on supply of goods or services that take place in

any of the seven union territories in India. The UTGST is collected along with the CGST.

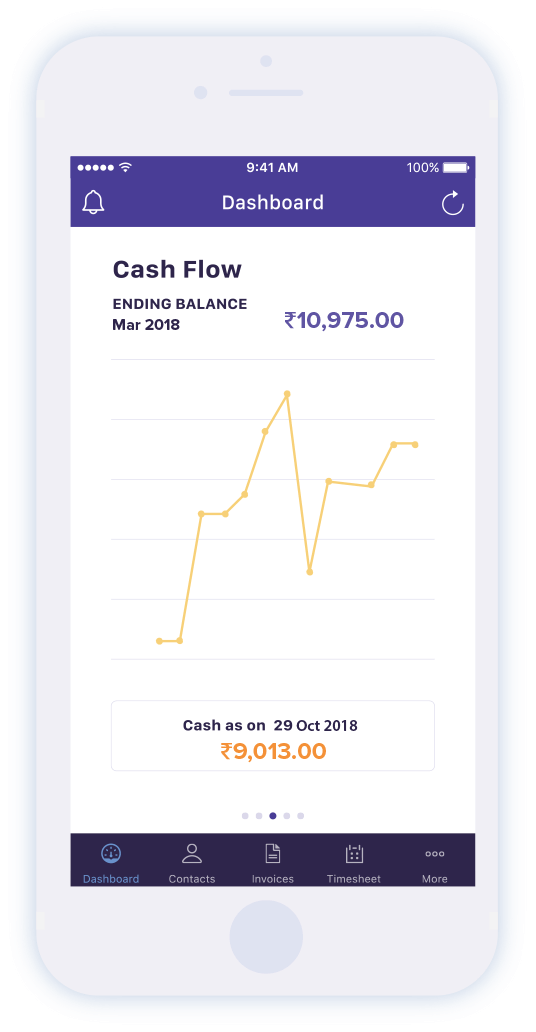

Looking for something beyond just calculating GST?

Zoho Books helps you create GST invoices, know your tax liability, and file your tax returns directly. Keep your

business GST compliant, all year long with GST accounting software - Zoho Books.

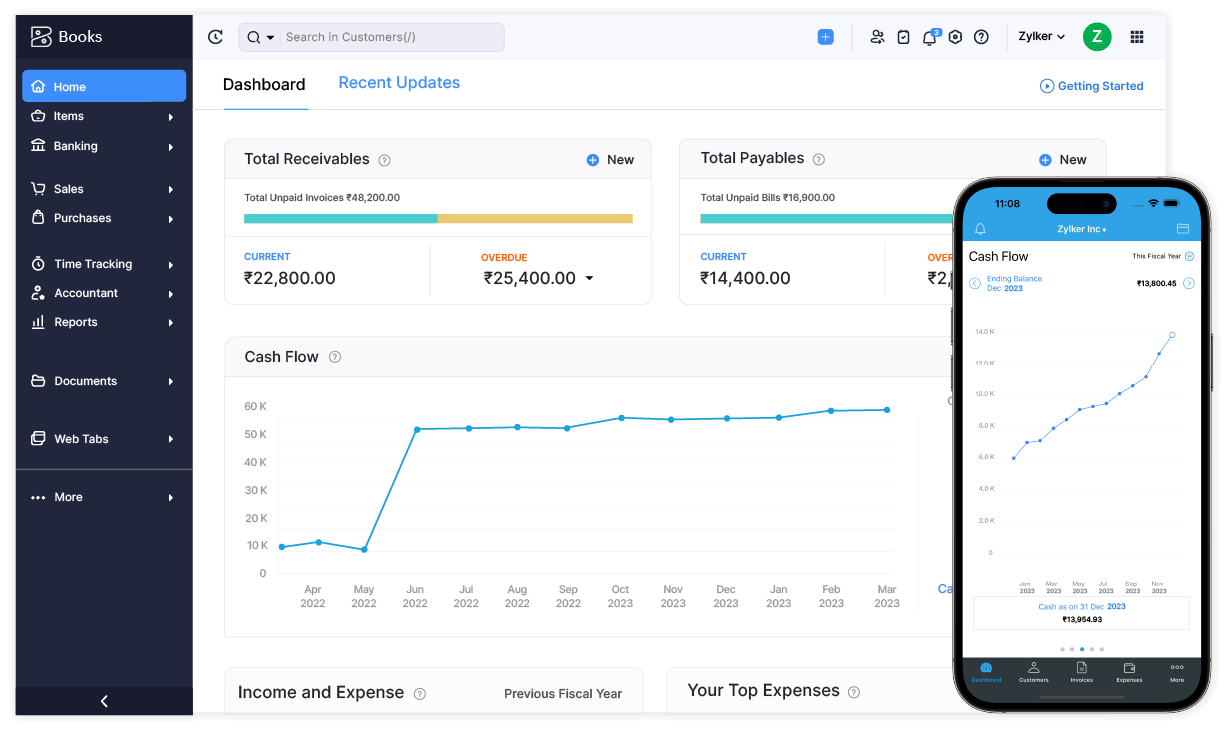

More of Zoho Books' capabilities for business

Manage receivables and payables effortlessly

Create items and track inventory

Reconcile bank accounts easily

Create and manage multiple projects

Get brilliant insights with 50+ reports

GST Compliant hassle free accounting, now a Reality!

- Receivables

- Payables

- Inventory

- Banking

- Timesheet

- Contacts

- Automation

- Reports