- HOME

- Accounting Principles

- Income statement – Definition, Importance and Example

Income statement – Definition, Importance and Example

What is income statement?

An income statement is a financial statement that shows you the company’s income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

The income statement is also known as a profit and loss statement, statement of operation, statement of financial result or income, or earnings statement.

Importance of an income statement

An income statement helps business owners decide whether they can generate profit by increasing revenues, by decreasing costs, or both. It also shows the effectiveness of the strategies that the business set at the beginning of a financial period. The business owners can refer to this document to see if the strategies have paid off. Based on their analysis, they can come up with the best solutions to yield more profit.

Following are the few other things that an income statement informs.

Frequent reports: While other financial statements are published annually, the income statement is generated either quarterly or monthly. Due to this, business owners and investors can track the performance of the business closely and make informed decisions. This also enables them to find and fix small business problems before they become large and expensive.

Pinpointing expenses: This statement highlights the future expenses or any unexpected expenditures which are incurred by the company, and any areas which are over or under budget. Expenses include building rent, salaries and other overhead costs. As a small business begins to grow, it may find its expenses soaring. These expenditures may involve hiring workers, buying supplies and promoting the business.

Overall analysis of the company: This statement gives investors an overview of the business in which they are planning to invest. Banks and other financial institutions can also analyze this document to decide whether the business is loan-worthy.

Who uses an income statement?

There are two main groups of people who use this financial statement: internal and external users. Internal users include company management and the board of directors, who use this information to analyze the business’s standing and make decisions in order to turn a profit. They can also act on any concerns regarding cash flow. External users comprise investors, creditors, and competitors. Investors check whether the company is positioned to grow and be profitable in the future, so they can decide whether to invest in the business. Creditors use the income statement to check whether the company has enough cash flow to pay off its loans or take out a new loan. Competitors use them to get details about the success parameters of a business and get to know about areas where the business is spending an extra bit, for example, R&D spends.

Income statement format with the major components

The following information is covered in an income statement. The format for this document may vary depending on the regulatory requirements, the diverse business needs and the associated operating activities.

Revenue or sales: This is the first section on the income statement, and it gives you a summary of gross sales made by the company. Revenue can be classified into two types: operating and non-operating. Operating revenue refers to the revenue gained by a company by performing primary activities like manufacturing a product or providing a service. Non-operating revenue is gained by performing non-core business activities such as installation, operation, or maintenance of a system.

Cost of goods sold (COGS): This is the total cost of sales or services, also referred to as the cost incurred to manufacture goods or services. Keep in mind that it only includes the cost of products which you sell. COGS does not usually include indirect costs, like overhead.

Gross profit: Gross profit is defined as net sales minus the total cost of goods sold in your business. Net sales is the amount of money you brought in for the goods sold, while COGS is the money you spent to produce those goods.

Gains: Gain is a result of a positive event that causes an organization’s income to increase. Gains indicate the amount of money realized by the company from various business activities like the sale of an operating segment. Likewise, the profits from one time non-business activities are also included as gains for the business. For example, company selling off old vehicles or unused lands etc. Although gain is considered secondary type of revenue, the two terms are different. Revenue is the money received by a company regularly while gain can be accounted for the sale of fixed assets, which is counted as a rare activity for a company.

Expenses: Expenses are the costs that the company has to pay in order to generate revenue. Some examples of common expenses are equipment depreciation, employee wages, and supplier payments. There are two main categories for business expenses: operating and non-operating expenses. Expenses generated by company’s core business activities are operating expenses, while the ones which are not generated by core business activities are known as non-operating expenses. Sales commission, pension contributions, payroll account for operating expenses while examples of non operating expenses include obsolete inventory charges or settlement of lawsuit.

Advertising expenses: These expenses are simply the marketing costs required to expand the client base. They include advertisements in print and online media as well as radio and video ads. Advertising costs are generally considered part of Sales, General & Administrative (SG&A) expenses.

Administrative expenses: It can be defined as the expenditure incurred by a business or company as a whole rather than being the ones associated with specific departments of the same company. Some of the examples of administrative expenses are salaries, rent, office supplies, and travel expenses. Administrative expenses are fixed in nature and tend to exist irrespective of the level of sales.

Depreciation: Depreciation refers to the practice of distributing the cost of a long-term asset over its life span. It is a management accord to write off a company’s asset value but it is considered a non-cash transaction. Depreciation mainly shows the asset value used up by the business over a period of time.

Earnings before tax (EBT): This is a measure of a company’s financial performance. EBT is calculated by subtracting expenses from income, before taxes. It is one of the line items on a multi-step income statement.

Net income: Net profit can be defined as the amount of money you earn after deducting allowable business expenses. It is calculated by subtracting total expenses from total revenue. While net income is a company’s earnings, gross profit can be defined as the money earned by a company after deducting the cost of goods sold.

How to read an income statement

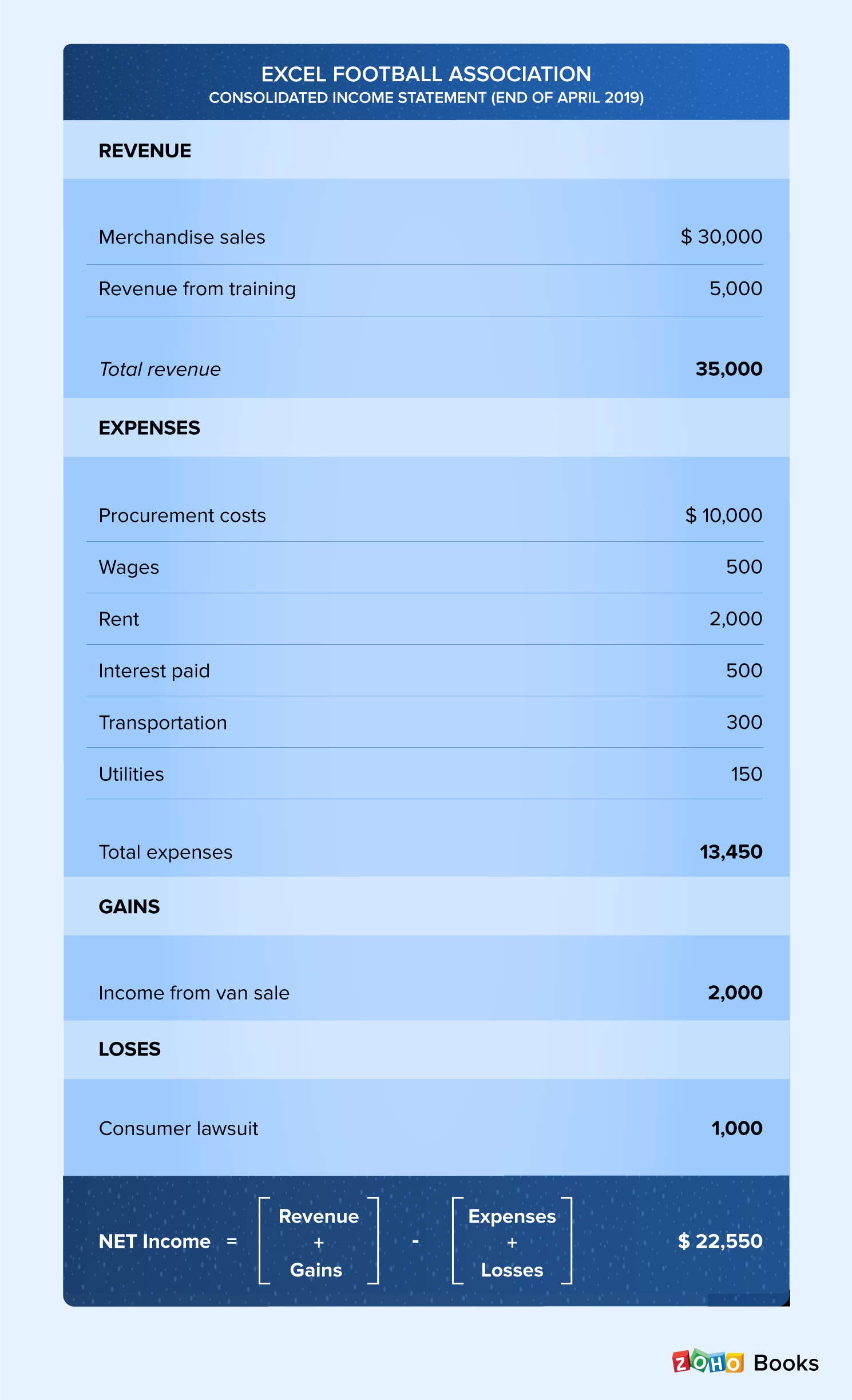

To understand an income statement, let’s use an example. Here’s the income statement for the first quarter of this year for a new local football association.

SINGLE-STEP INCOME STATEMENT EXAMPLE

From the above example, you can see that the association earned $30,000 from the sale of goods and another $5,000 by charging for training. The association spent money on various activities, to arrive at total expenses of $13,450. They gained $2,000 by selling an old van, while facing a loss of $1,000 for settling a pending consumer lawsuit. Now, to calculate the net income, let us enter the values in the following equation:

Net Income = (Revenue + Gains) – (Expenses + Losses)

= (35,000 + 2,000) – (13,450 + 1,000) = $22,550

The above example is one of the simplest types of income statements, where you apply the values of income, expense, gains and loss into the equation to arrive at the net income. Since it is based on a simple calculation, it is called a single-step income statement.

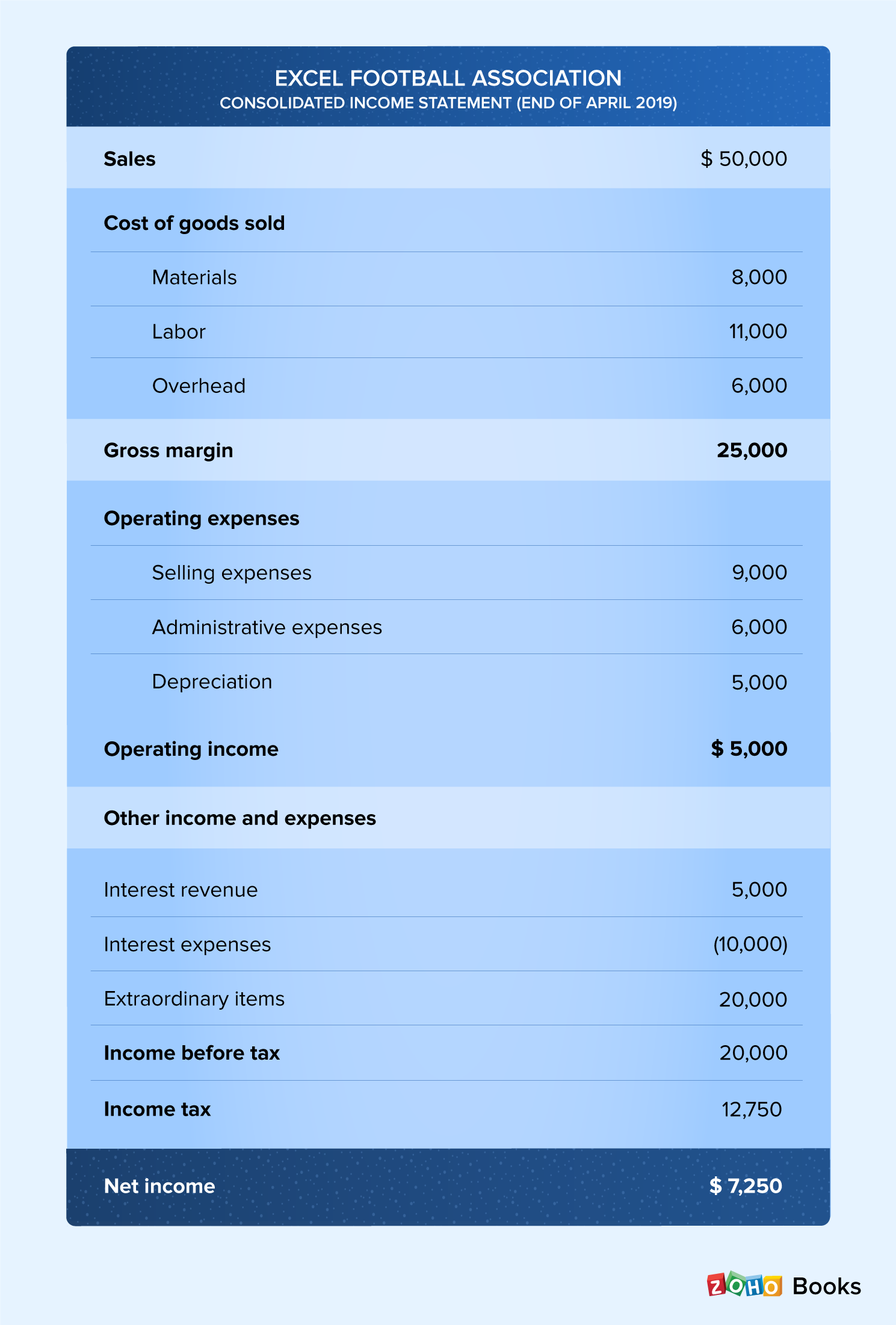

MULTI-STEP INCOME STATEMENT EXAMPLE

In the real world, companies that operate at a global level provide a wide range of products and services and involve themselves in mergers and partnerships. Due to these activities, they have a complex list of activities and expenses to note. These companies also have to comply with specific reporting regulations. So bigger companies opt for multi-step income statements. In this system, operating revenues, operating expenses, and gains are separated from non-operating expenses, non-operating revenues, and losses. Profitability is represented at four levels: gross, operating, pre-tax, and post-tax. The following example uses the same company data as the single-step income statement.

Conclusion

An income statement is a rich source of information about the key factors responsible for a company’s profitability. It gives you timely updates because it is generated much more frequently than any other statement. The income statement shows a company’s expense, income, gains, and losses, which can be put into a mathematical equation to arrive at the net profit or loss for that time period. This information helps you make timely decisions to make sure that your business is on a good financial footing.