- HOME

- Accounting Principles

- Cost Sheet – Meaning, Example & Format

Cost Sheet – Meaning, Example & Format

What is a cost sheet?

A cost sheet is a statement that shows the various components of total cost for a product and shows previous data for comparison. You can deduce the ideal selling price of a product based on the cost sheet.

A cost sheet document can be prepared either by using historical cost or by referring to estimated costs. A historical cost sheet is prepared based on the actual cost incurred for a product. An estimated cost sheet, on the other hand, is prepared based on estimated cost just before the production begins.

Note: The cost sheet mentioned in this guide pertains to a financial concept and is not a feature to be activated within Zoho Books.

Importance and objectives of cost sheet

Cost sheets help with a number of essential business processes:

1. Determining cost: The main objective of the cost sheet is to obtain an accurate product cost. It gives you both the total cost and cost per unit of a product.

2. Fixing selling price: In order to fix the selling price of a product, you need to create a cost sheet so you can see the details of its production cost.

3. Cost comparison: It helps the management compare the current cost of a product with a previous per unit cost for the same product. Comparing the costs helps management take corrective measures if costs have increased.

4. Cost control: The cost sheet is an important document for a manufacturing unit, as it helps in controlling production costs. Using an estimated cost sheet aids in monitoring labour, material and overhead costs at each step of production.

5. Decision-making: Some of the most important decisions management makes are based on the cost sheet. Whenever a business needs to produce or buy a component, or quote prices for its goods on a tender, managers refer to the cost sheet.

Types of costs in cost accounting

Costs are broadly classified into four types: fixed cost, variable cost, direct cost, and indirect cost.

1. Fixed cost: These are costs that do not change based on the number of items produced. For example, the depreciating value of a building or the price of a piece of equipment.

2. Variable cost: These costs are tied to a company’s level of production. For example, a bakery spends $10 on labor and $5 on raw materials to produce each cake. The variable cost changes based on the number of cakes the company bakes.

3. Operating costs: These are those expenses incurred by an organisation to maintain the product on a day to day basis. Traveling cost, telephone expenses, office supplies are some of things that come under operating costs.

4. Direct costs: These costs can be directly associated with production. For example, if a furniture manufacturing company takes five days to produce a couch, then the direct cost of the finished product includes the raw material cost and labor charges for five days.

Components & elements of total cost

Components of total cost are constituted mainly of prime cost, factory cost, office cost and cost of sales. Let us take a detailed look at each of these elements:

1. Prime cost: This comprises direct material, direct wages, and direct expenses. It is also called basic cost, first cost, or flat cost. It can be defined as an aggregate of the price of the material consumed, the wages involved in production, and the direct expenses.

Prime cost = Direct material + Direct wages + Direct expenses

Direct material cost usually refers to the cost of raw materials used or consumed during a given period. To calculate the amount of raw material actually consumed during a given period, you add the opening stock and the amount of material purchased, and deduct the closing stock. Here is the formula for material consumed:

Material consumed = Material purchased + Opening stock of material – Closing stock of material

2. Factory cost: This is made up of prime cost plus factory overhead, which includes indirect wages, indirect material and indirect expenses. Factory cost is also known as works cost, production cost, or manufacturing cost.

Factory cost = Prime cost + Factory overhead

3. Office cost: This is also called administration cost or total cost of production. Office cost is equal to factory cost plus office and administration overhead.

4. Total cost or cost of sales: This is the sum of the total cost of production and the total of selling and distribution overhead.

Total cost = Cost of goods sold + Selling and distribution overhead

In the production process, some units of a product are scheduled to be finished at the end of a period. Such incomplete units are called work-in-progress. In such situations, while calculating the factory cost of a product unit, it is necessary to make adjustment for opening and closing stock to arrive at net factory cost of the product. Generally, the cost of these unfinished units include direct material, direct expenses, and factory overheads.

Besides this, the adjustments for inventories need to be made in the following manner

1. Direct material consumed = Opening stock of direct material + Purchases of direct material – Closing stock of direct

2. Works cost = Gross works cost + Opening work in progress – Closing work in progress

3. Cost of production of goods sold = Cost of production + Opening stock of finished goods – closing stock of finished goods

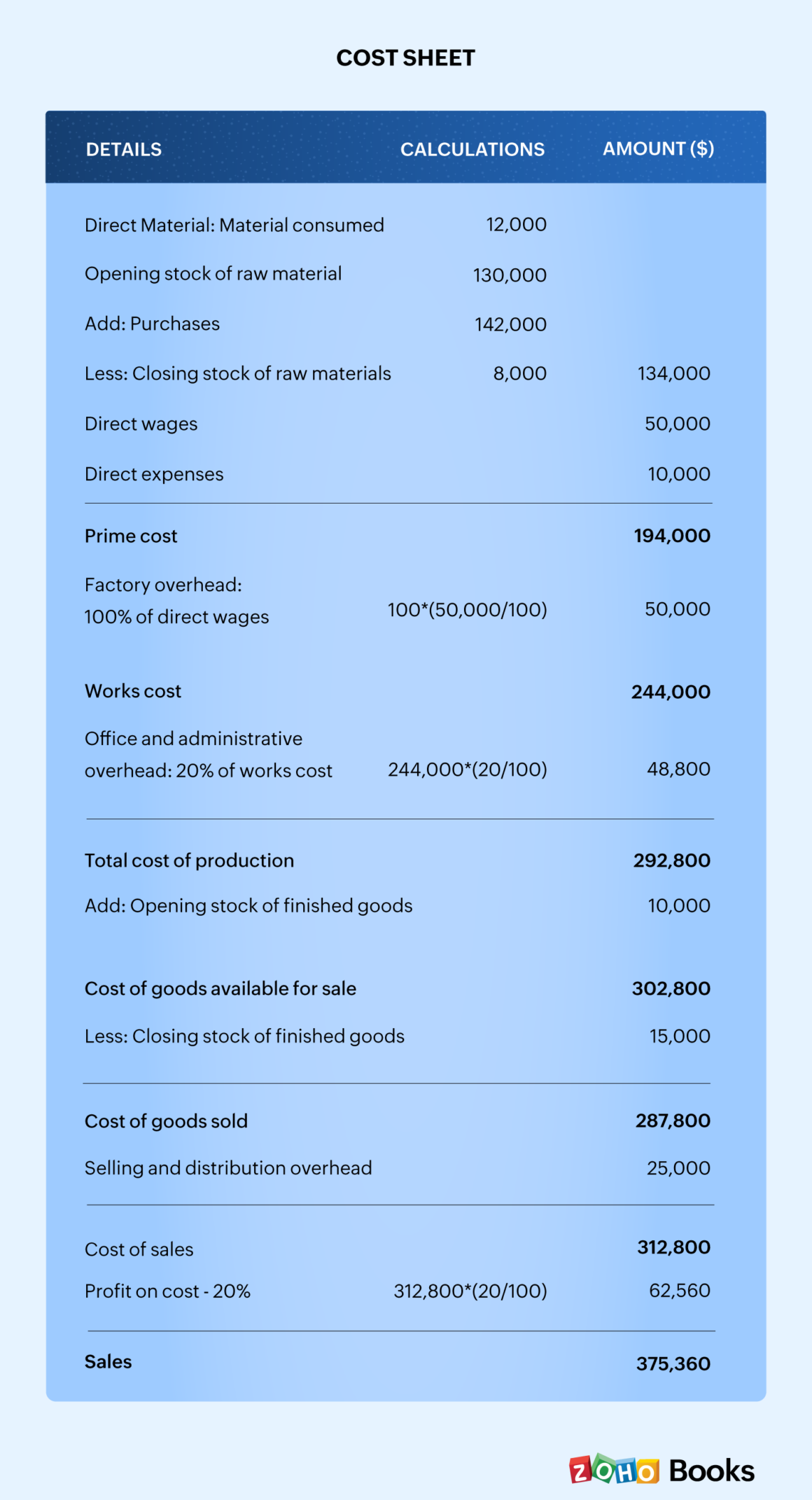

Cost sheet example

The various components of cost explained in the previous section can be represented in the form of a statement. A cost sheet statement consists of prime cost, factory cost, cost involved in the production of goods sold, and total cost. Let us look at an example, in which you have to prepare a cost sheet for a furniture company for the financial year ending March 31, 2019. Now take a look at the following information which is available to you to prepare a cost sheet statement.

Direct material consumed – $12,000

Opening stock of raw materials – $130,000

Closing stock of raw materials – $8,000

Direct wages – $50,000

Direct expenses – $10,000

Factory overhead is 100% of direct wages

Office and administration overhead is 20% of works

Selling and distribution overhead – $25,000

Cost of opening stock for finished goods – $10,000

Cost of closing stock for finished goods – $15,000

Profit on cost is 20%

Conclusion

A cost sheet analyzes the components of cost in order to show the per-unit cost for a given product. Business managers use cost sheets as reference documents to help manage purchasing and production costs, and to find the right selling prices for products and services. While there are other ways to manage costs, most companies choose to use cost sheets because it’s an efficient way to track and control different kinds of costs.