How CRM systems help financial services providers maximise growth

- Last Updated : March 6, 2024

- 1.1K Views

- 3 Min Read

In financial services, building and maintaining strong customer relationships is key to success. This is where a customer relationship management (CRM) system comes in. It is a powerful tool that can help financial services providers streamline operations, improve customer satisfaction, and drive revenue growth. In this blog, we'll explore the benefits of using a CRM in financial services.

Centralised customer data

Unified view of customer information

A CRM system for financial services providers enables better communication and relationships with clients by consolidating all customer data in one place and avoiding duplicates or inconsistencies. This unified view of customer information allows firms to understand their clients better and make informed decisions.

Data security

Financial services businesses must implement strong security measures to keep sensitive information secure. This includes encryption, access controls, and regular backups in a centralised data system, like a cloud-based CRM. These measures provide a robust defence against potential breaches, safeguarding not only the company's assets but also the trust of its customers.

Maintaining compliance with data protection regulations such as the Australian Privacy Act 1988 is also essential. Failure to comply with these regulations can result in significant penalties. For instance, severe breaches of privacy under the Act can attract penalties of up to $50 million AUD, three times the value of any benefit obtained through the misuse of information, or 30% of the organisation's annual domestic turnover—whichever is greatest.

Personalised, contextual recommendations

Insights into customer preferences

A well-integrated CRM system brings together data from multiple sources, including information about customers' purchases and their communication history with the business. This knowledge helps firms provide tailored recommendations, service, and support to fit each client's needs and goals.

Proactive customer engagement

CRM systems help financial services providers stay connected with their customers by utilising tools such as sentiment analysis and automated reminders. For example, when a customer expresses interest or concern regarding a particular investment opportunity, the system can instantly alert the provider and provide contextual details so they can guide the customer to the right decision.

Automated follow-ups configured on a CRM ensure that communication lines remain open and consistent, helping financial providers build trust in the relationship. Proactive check-ins not only help identify and resolve issues quickly but also enable providers to establish themselves as a reliable and committed partner.

Integration with communication platforms

Data integration enhances a CRM system. Having communication tools such as email, messaging, and video conferencing within the CRM streamlines conversations, centralises data logs, and ensures timely responses to issues that matter the most, whether providers are working on the web or from mobile devices. Furthermore, integration with a marketing tool can automate targeted campaigns and lead nurturing processes, improving marketing effectiveness and conversion rates.

Enhanced sales forecasting and opportunities for growth

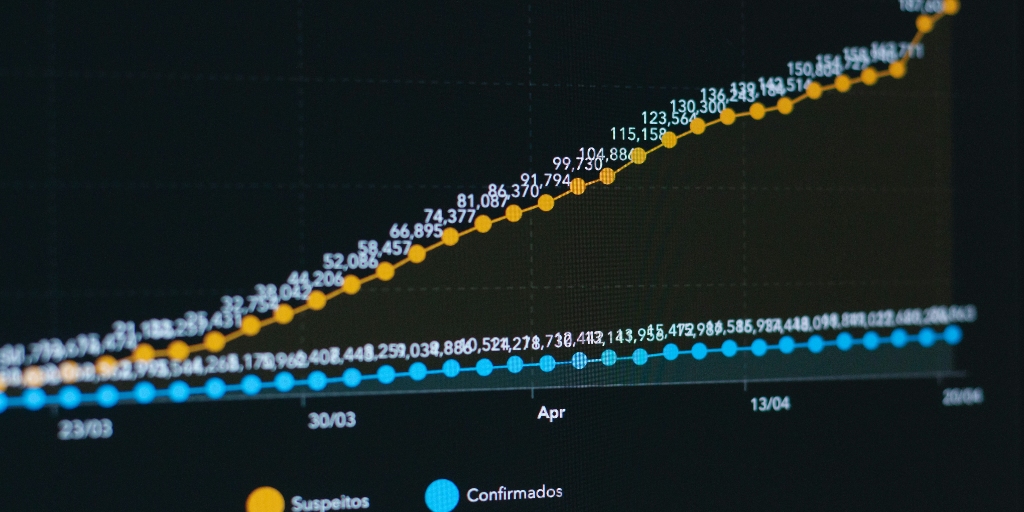

Real-time insights

CRM systems provide financial services providers with real-time insights to help them understand their customers' behaviour and preferences. By grouping customers based on their buying habits, demographics, and communication preferences, businesses can create targeted marketing campaigns and personalised sales strategies. CRM insights also help identify cross-selling and upselling opportunities, ultimately increasing revenue potential.

Revenue growth

CRM systems help financial services providers refine their sales strategies and achieve sustainable revenue growth. Integrating your CRM with an accounting system like Zoho Books helps further streamline your sales and accounting processes. This can help you save time and avoid errors by automating tasks like invoicing, payments, and financial reporting.

By using a CRM system to monitor important metrics like conversion rates, customer lifetime value, and sales pipeline velocity, sales reps can identify areas for improvement. This helps them stay flexible and responsive to changes in the market, leading to long-term success and profitability.

Check out our detailed blog post to learn more about how you can benefit by integrating your finance and CRM systems.

In conclusion, a CRM system is an essential tool for financial services providers to build and retain strong customer relationships. By utilising a CRM system, financial services providers can simplify their operations, enhance customer satisfaction, and drive revenue growth to support long-term success.