Cost accounting is a business practice in which you record, examine, summarize, and understand the money that a business spent on a process, product, or service. It can help an organization control costs and engage in strategic planning to improve cost efficiency. Cost accounting helps management decide where they need to cut back and where they need to increase costs.

Importance of cost accounting

Cost accounting has many advantages. Here are some of the ways it can help a business:

1. Controlling costs: Cost accounting helps the management foresee the cost price and selling price of a product or a service, which helps them formulate business policies. With cost value as a reference, the management can come up with techniques to control costs with an aim to achieve maximum profitability.

2. Determining the total per-unit cost: Cost accounting techniques help in determining the total per-unit cost of a product or a service, so that the business can fix the selling price for it.

3. Showing profitable and non-profitable activities: This information helps the management put an end to non-profitable activities while developing and expanding the profitable ones.

4. Comparing costs over time: The data in the cost sheets prepared for various time periods helps in comparing the cost for the same product or a service over a period of time.

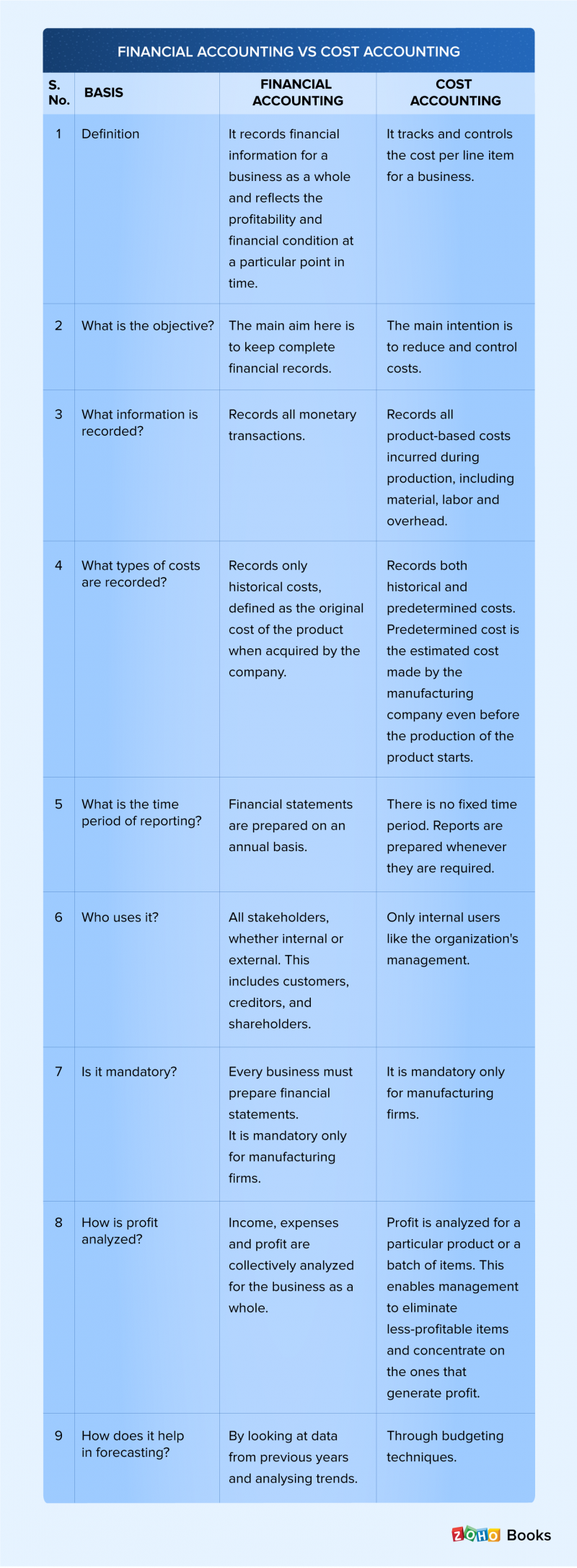

Difference between cost accounting and financial accounting

Cost accounting and financial accounting use the same information from the business’ records and work around the same principles. The difference between the two is that financial accounting gives the value of profit and loss of the business as a whole, while cost accounting tells you about the cost per item and the profit or loss associated with individual products.

Let us look at a few points of distinction between the two:

Elements of cost in cost accounting

The elements of cost are broadly classified into material, labor, and expenses. Each of them is further divided into direct and indirect costs. The indirect material, labor and expenses can be categorized as overhead costs.

Let’s take a detailed look at these elements.

Material cost: This is the cost of the basic substances that are used to produce an item. It can be further classified into direct material and indirect material.

-

Direct material: Materials which are directly involved in the manufacturing of a product and are present in the finished product constitute direct material. For example, wood used to make furniture, or cloth used to make a shirt.

-

Indirect material: Materials which are instrumental in the production of finished goods but cannot be assigned to specific physical units. For example, a pair of scissors to cut the cloth for the shirt, or a saw to cut the wood for furniture.

Labor cost: These are the human resources required to convert materials into finished goods. They can be further classified into direct and indirect labor.

-

Direct labor: People who are involved actively during the manufacturing of products. For example, production or manufacturing labor.

-

Indirect labor: Employees who are not directly involved in the manufacturing process and whose labor cannot be assigned to one particular product. For example, sales representatives and directors.

Expenses: Costs incurred by a business, other than material and labor costs, generally fall under this category. They are further divided into direct and indirect expenses.

-

Direct expenses: These are also called chargeable expenses and are usually associated with specific cost units. For example, direct labor, cost of raw materials, utilities, and rent.

-

Indirect expenses: All expenses that do not fall under direct expenses are considered indirect expenses. For example, printing costs, utility bills, and legal consultation.

Overhead costs: The general understanding is that overhead costs are similar to indirect expenses. But overhead actually has a wider meaning, which includes indirect labor, indirect material, and indirect expenses.

Overhead costs can be classified into the following three categories:

-

Factory overhead: This includes overhead cost incurred due to manufacturing, production, or any other type of cost that is responsible for the smooth functioning of a factory. For example, factory rent, insurance, and utilities.

-

Office and administrative overhead: These are expenses connected to the management and administration of a business. For example, office rent, printers, and stationery.

-

Selling and distribution overhead: These are expenses related to marketing a product, acquiring orders, and dispatching goods and services.

Methods of cost accounting

There are four main types of cost accounting techniques.

1. Standard cost accounting: This type of cost accounting uses ratios to check the utilization of labor and goods to produce goods in a standard environment. This assessment is called a variance analysis. However, this method is somewhat dated. When it was introduced a century ago, it made sense to use labor as the only cost measurement, as it was an important cost driver. With time, overhead costs have increased compared to labor.

2. Activity-based cost accounting: In this method, the cost of each activity performed in an organization is allocated to a specific product or service. The way in which these costs are assigned to cost objects is first decided by performing activity analysis. This improves the costing accuracy of products and services.

3. Lean accounting: This is a compilation of principles and processes that provides numerical feedback to manufacturers applying lean manufacturing and inventory practices. Lean manufacturing helps management accelerate processes, eradicate errors, and free up production capacity.

Lean accounting does not rely on activity-based costing or standard costing; instead, it uses visual and lean-focused performance measurements.

4. Marginal costing: Marginal cost is defined as the additional cost involved in manufacturing an extra unit of output. This method is also called the cost-profit-volume analysis. Marginal cost analysis looks at the relationship between production volume, selling price, costs, expenses and profits. It is calculated by subtracting variable cost from revenue, then dividing by revenue.

Conclusion

Cost accounting is a system of recording and analyzing the cost of products or services in order to contribute towards strategic planning and improve cost efficiency. It’s important for many parties involved in a business, including management, employees, and consumers. Although cost accounting and financial accounting are interrelated, they provide different results. Cost accounting tells you about the cost of producing individual items, while financial accounting shows you profit and loss for the company as a whole. While there are advantages to using a dedicated cost accounting system, a company that’s efficient enough to track its own costs can manage all its records without having a formal system in place.