- HOME

- Taxes & compliance

- A Guide to VAT Registration in the United Arab Emirates

A Guide to VAT Registration in the United Arab Emirates

Business owners in the UAE can start registering for VAT on 1st October, 2017. This guide explains the process involved in registering your business for VAT.

This section will cover the following topics

- Eligibility for registration

- How to register for VAT?

- Supporting Documents

- VAT Timeline

- Who can register as a VAT group?

- Deregistration

Eligibility for registration

The thresholds for businesses to register for VAT are based on the value of their taxable supplies, which include standard-rated supplies, zero-rated supplies, reverse charges received, and imported goods.

Mandatory Registration

- A business must register for VAT if the total value of its taxable supplies and imports within the UAE exceeds the mandatory registration threshold of AED 375,000, either during the previous 12 months or within the upcoming 30 days.

Voluntary Registration

- A business can voluntarily register for VAT if the total value of its taxable supplies and imports within the UAE exceeds the voluntary registration threshold of AED 187,500, either during the previous 12 months or within the upcoming 30 days.

- A business can also register voluntarily if its expenses exceed the voluntary registration threshold.

Non-resident Registration

- A non-resident doing taxable business in the UAE needs to register for VAT regardless of the above-mentioned thresholds.

VAT will come into effect on 1st January, 2018. The electronic registration portal for VAT will be open during the fourth quarter of 2017 on the Federal Tax Authority (FTA) website.

How to register for VAT?

Businesses can start registering for VAT on 1st October, 2017 by logging in to the online VAT registration portal provided by the Federal Tax Authority (FTA). The registration is a simple process:

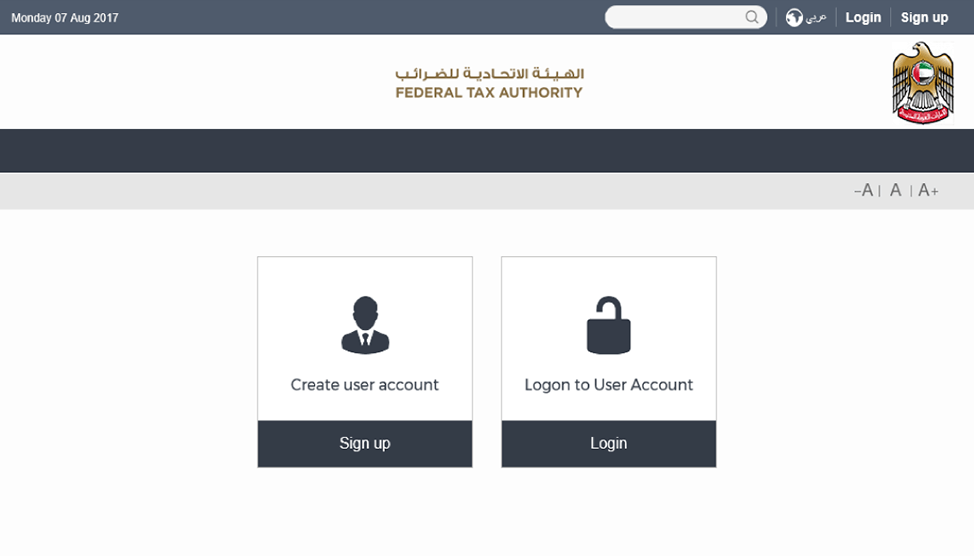

1. Open the VAT registration portal on FTA website and create a user account.

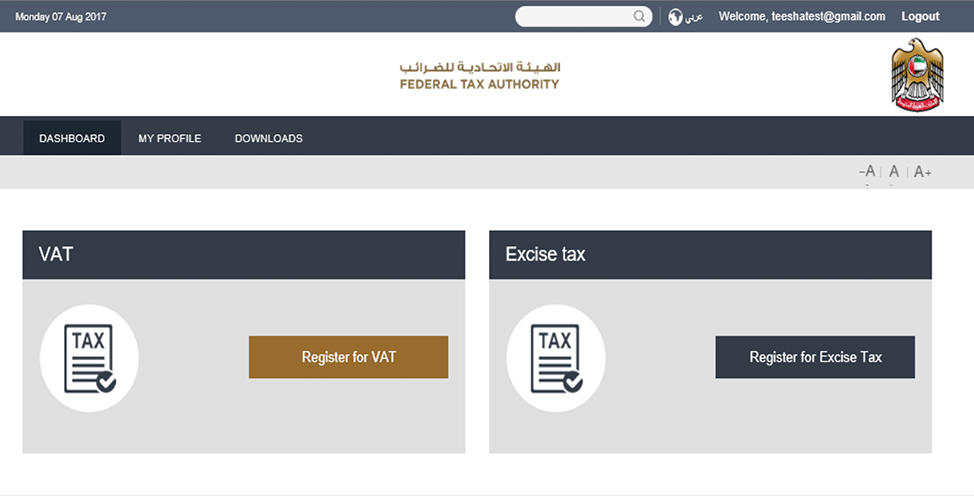

2. After you create your account, an email will be sent to you to verify the details and activate your account. Now you can log in to the portal using your user credentials.

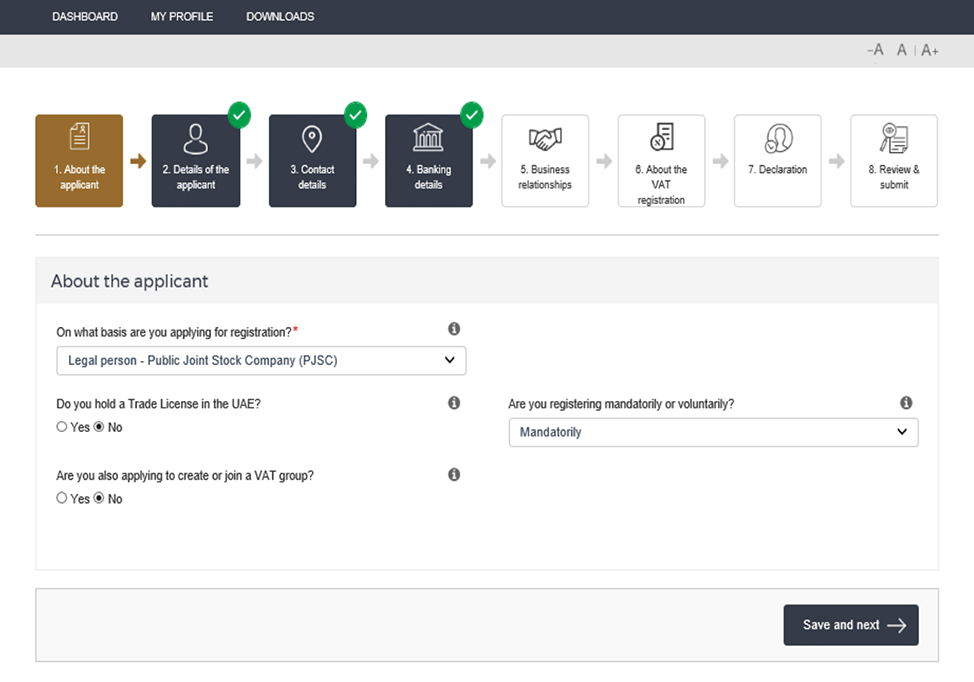

3. Once you have logged in, navigate to the VAT registration form and furnish the necessary details to complete the registration.

4. Provide supporting documents to validate your information, including

- Passport copy

- Emirates ID

- Trade licence

- Any other official documents authorizing your business to conduct trade within the UAE.

Provide the following details about your business:

- Description of the business.

- Turnover figures for the previous 12 months.

- Projected turnover figures for the future.

- Expected values of imports and exports.

5. Once you have completed the application, click Submit. The FTA will process your application and respond with an email confirming your Tax Registration Number (TRN).

VAT timeline

| Annual turnover | Date for registration |

|---|---|

| Greater than AED 150 million | Before 31 October 2017 |

| Greater than AED 10 million | Before 30 November 2017 |

Businesses registering for VAT will not face any registration penalty until April 30th 2018, but they are required to settle all the taxes due from January 1st 2018. Earlier, the deadline for VAT registration was December 4th 2017, which has been extended by the FTA to April 30th 2018.

Who can register as a VAT group?

If a company has multiple entities that trade with each other, it is possible to register as a VAT group. In a group registration, all of the entities within the VAT group are treated as one entity for VAT purposes. The supplies made between members of a VAT group are disregarded (no VAT is due on them). The supplies made by the VAT group to an entity outside the VAT group are subject to normal VAT rules. When a company registers as a VAT group, it receives a single TRN and will file a single VAT return.

Deregistration

A VAT-registered person in the UAE can apply to de-register if they meet any of the following conditions:

- The registered person no longer makes taxable supplies.

- The value of their taxable supplies is less than the voluntary registration threshold of 187,500 AED over a period of 12 consecutive months.

- The value of their taxable supplies is less than the mandatory threshold of 375,000 AED over a period of 12 months.

A person who registers for VAT voluntarily must stay registered for at least 12 months before applying to de-register.

Every member state of the GCC can determine the minimum period for which taxpayers must remain registered. Taxpayers cannot deregister before the minimum date set by their state. Member states can also set additional conditions for taxpayers to be considered for deregistration.

After a taxable person applies for deregistration, the FTA will notify them whether they have been deregistered and specify the date from which the deregistration will be effective.